Yahoo 2005 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2005 Yahoo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

74

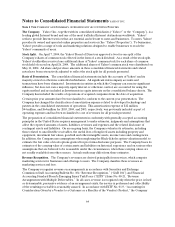

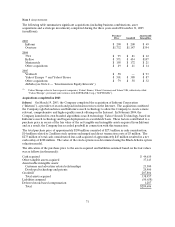

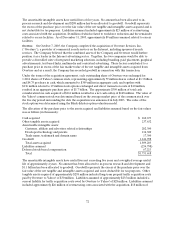

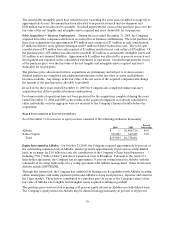

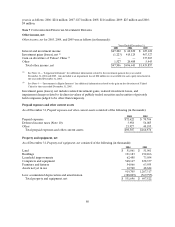

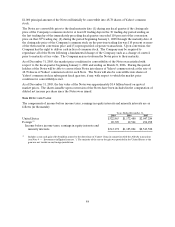

The allocation of the purchase price to the assets acquired and liabilities assumed based on the fair values

was as follows (in thousands):

Cash acquired $ 38,817

Other tangible assets acquired 24,068

Amortizable intangible assets:

Customer, affiliate and advertiser related relationships 36,100

Developed technology and patents 9,100

Trade name, trademark and domain name 61,300

Goodwill 453,555

Total assets acquired 622,940

Liabilities assumed (51,832)

Total $ 571,108

The amortizable intangible assets have useful lives not exceeding five years and a weighted average useful

life of approximately 5 years. No amount has been allocated to in-process research and development and

$454 million has been allocated to goodwill. Goodwill represents the excess of the purchase price over the

fair value of the net tangible and intangible assets acquired and is not deductible for tax purposes.

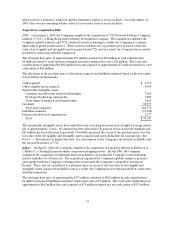

Musicmatch. On October 18, 2004, the Company completed the acquisition of Musicmatch, Inc.

(“Musicmatch”), a leading provider of personalized music software and services. The acquisition

significantly increased the Company’s presence in the digital music business and together with the

Company’s existing music services, Yahoo! Music, provided one of the most comprehensive suite of music

services for users, marketers, artists and record labels. These factors contributed to a purchase price in

excess of the fair value of net tangible and intangible assets acquired from Musicmatch and as a result, the

Company has recorded goodwill in connection with this transaction.

The total purchase price of $158 million consisted of $157 million in cash consideration and direct

transaction costs of $1 million. The $157 million of total cash consideration less cash acquired of

$3 million resulted in a net cash outlay of $154 million.

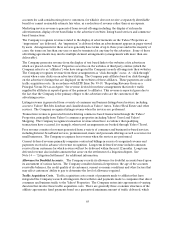

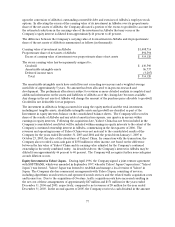

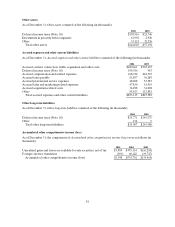

The allocation of the purchase price to the assets acquired and liabilities assumed based on the fair values

was as follows (in thousands):

Cash acquired $ 2,516

Other tangible assets acquired 8,591

Amortizable intangible assets:

Customer contracts and related relationships 1,700

Developed technology and patents 18,100

Trade name, trademark and domain name 1,100

Goodwill 171,633

Total assets acquired 203,640

Liabilities assumed (45,317)

Total $ 158,323

The amortizable intangible assets have useful lives of three years. No amount has been allocated to in-

process research and development and $172 million has been allocated to goodwill. Goodwill represents

the excess of the purchase price over the fair value of the net tangible and intangible assets acquired and is

not deductible for tax purposes.