Target 2014 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2014 Target annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

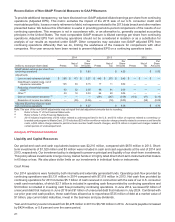

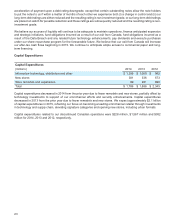

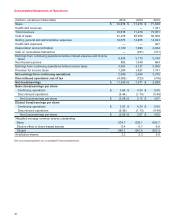

Reconciliation of Non-GAAP Financial Measures to GAAP Measures

To provide additional transparency, we have disclosed non-GAAP adjusted diluted earnings per share from continuing

operations (Adjusted EPS). This metric excludes the impact of the 2013 sale of our U.S. consumer credit card

receivables portfolio, losses on early retirement of debt, net expenses related to the 2013 data breach and other matters

presented below. We believe this information is useful in providing period-to-period comparisons of the results of our

continuing operations. This measure is not in accordance with, or an alternative to, generally accepted accounting

principles in the United States. The most comparable GAAP measure is diluted earnings per share from continuing

operations. Adjusted EPS from continuing operations should not be considered in isolation or as a substitution for

analysis of our results as reported under GAAP. Other companies may calculate non-GAAP adjusted EPS from

continuing operations differently than we do, limiting the usefulness of the measure for comparisons with other

companies. Prior year amounts have been revised to present Adjusted EPS on a continuing operations basis.

2014 2013 2012

(millions, except per share data) Pretax

Net of

Tax

Per

Share

Amounts Pretax

Net of

Tax

Per

Share

Amounts Pretax

Net of

Tax

Per

Share

Amounts

GAAP diluted earnings per share from

continuing operations

Adjustments

Loss on early retirement of debt

Data Breach-related costs, net of

insurance receivable (a)

Reduction of beneficial interest

asset (b)

Other (c)

Gain on receivables transaction (b)

Resolution of income tax matters

$ 285

145

53

29

—

—

$ 173

94

32

18

—

(35)

$ 3.83

$ 0.27

0.15

0.05

0.03

—

(0.06)

$ 445

17

98

64

(391)

—

$ 270

11

61

40

(247)

(16)

$ 4.20

$ 0.42

0.02

0.09

0.06

(0.38)

(0.03)

$ —

—

—

—

(152)

—

$ —

—

—

—

(97)

(58)

$ 5.00

$ —

—

—

—

(0.15)

(0.09)

Adjusted diluted earnings per share

from continuing operations $ 4.27 $ 4.38 $ 4.76

Note: The sum of the non-GAAP adjustments may not equal the total adjustment amounts due to rounding.

(a) Refer to Note 17 of the Financial Statements.

(b) Refer to Note 7 of the Financial Statements.

(c) 2014 includes impairments of $16 million related to undeveloped land in the U.S. and $13 million of expense related to converting co-

branded card program to MasterCard. 2013 includes a $23 million workforce-reduction charge primarily related to severance and benefits

costs, a $22 million charge related to part-time team member health benefit changes, and $19 million in impairment charges related to

certain parcels of undeveloped land.

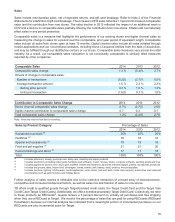

Analysis of Financial Condition

Liquidity and Capital Resources

Our period-end cash and cash equivalents balance was $2,210 million, compared with $670 million in 2013. Short-

term investments of $1,520 million and $3 million were included in cash and cash equivalents at the end of 2014 and

2013, respectively. Our investment policy is designed to preserve principal and liquidity of our short-term investments.

This policy allows investments in large money market funds or in highly rated direct short-term instruments that mature

in 60 days or less. We also place dollar limits on our investments in individual funds or instruments.

Cash Flows

Our 2014 operations were funded by both internally and externally generated funds. Operating cash flow provided by

continuing operations was $5,131 million in 2014 compared with $7,519 million in 2013. Net cash flow provided by

continuing operations for 2013 includes $5.7 billion of cash received in connection with the sale of our U.S. consumer

credit card receivables, of which $2.7 billion is included in operating cash flow provided by continuing operations and

$3.0 billion is included in investing cash flow provided by continuing operations. In June 2014, we issued $1 billion of

unsecured debt that matures in June 2019 and $1 billion of unsecured debt that matures in July 2024. Combined with

our prior year-end cash position, these cash flows allowed us to repurchase $725 million of debt at a market value of

$1 billion, pay current debt maturities, invest in the business and pay dividends.

Year-end inventory levels increased from $8,278 million in 2013 to $8,790 million in 2014. Accounts payable increased

by $424 million, or 5.8 percent over the same period.

21