Target 2014 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2014 Target annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

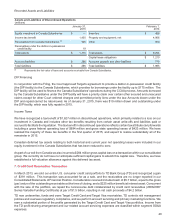

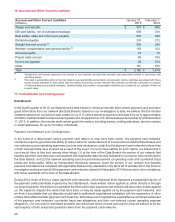

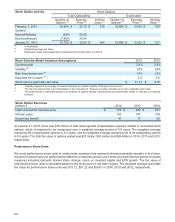

Future Minimum Lease Payments

(millions) Operating Leases (a) Capital Leases (b) Rent Income Total

2015 $ 186 $ 123 $ (6) $ 303

2016 178 94 (5) 267

2017 170 58 (5) 223

2018 165 55 (4) 216

2019 154 54 (3) 205

After 2019 2,974 1,019 (13) 3,980

Total future minimum lease payments $ 3,827 $ 1,403 $ (36) $ 5,194

Less: Interest (c) 614

Present value of future minimum capital

lease payments (d) $ 789

Note: Minimum lease payments exclude payments to landlords for real estate taxes and common area maintenance. Minimum lease payments

also exclude payments to landlords for fixed purchase options which we believe are reasonably assured of being exercised.

(a) Total

contractual lease payments include $2,046 million related to options to extend lease terms that are reasonably assured of being

exercised and also includes $67 million of legally binding minimum lease payments for stores that are expected to open in 2015 or later.

(b) Capital

lease payments include $612 million related to options to extend lease terms that are reasonably assured of being exercised and

also includes $59 million of legally binding minimum lease payments for stores that are expected to open in 2015 or later. Capital leases

also include $41 million of legally binding payments for distribution centers opening in 2015.

(c) Calculated using the interest rate at inception for each lease.

(d) Includes the current portion of $63 million.

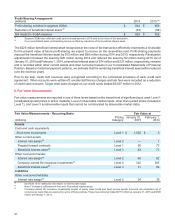

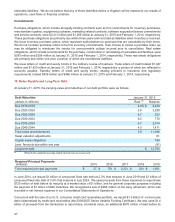

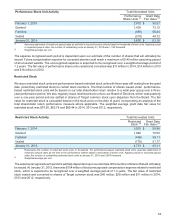

21. Income Taxes

Earnings from continuing operations before income taxes were $3,653 million, $4,121 million and $5,056 million during

2014, 2013 and 2012, including $261 million, $196 million and $161 million earned by our foreign entities subject to

tax outside of the U.S.

Tax Rate Reconciliation – Continuing Operations

Federal statutory rate

State income taxes, net of the federal tax benefit

International

Other

Effective tax rate

2014

35.0%

2.2

(2.3)

(1.9)

33.0%

2013

35.0%

2.4

(1.2)

(1.6)

34.6%

2012

35.0%

1.8

(1.0)

(1.4)

34.4%

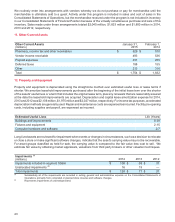

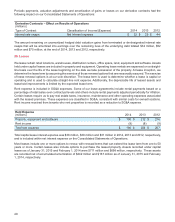

Provision for Income Taxes

(millions)

Current:

Federal

State

International

Total current

Deferred:

Federal

State

International

Total deferred

Total provision

$

$

2014

1,074 $

116

7

1,197

(2)

10

(1)

7

1,204 $

2013

1,206 $

150

13

1,369

56

—

2

58

1,427 $

2012

1,521

144

9

1,674

64

6

(3)

67

1,741

50