Target 2014 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2014 Target annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

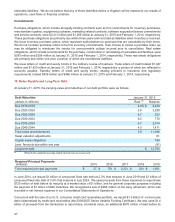

maturity. We recognized a loss of $445 million on the early retirement, which was recorded in net interest expense in

our Consolidated Statements of Operations.

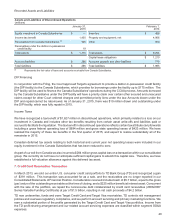

We periodically obtain short-term financing under our commercial paper program, a form of notes payable.

Commercial Paper

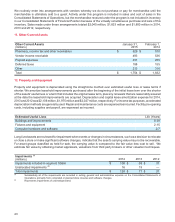

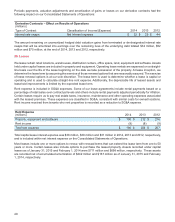

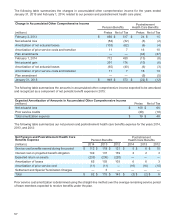

(dollars in millions) 2014 2013 2012

Maximum daily amount outstanding during the year $ 590 $ 1,465 $ 970

Average amount outstanding during the year 129 408 120

Amount outstanding at year-end — 80 970

Weighted average interest rate 0.11% 0.13% 0.16%

No balances were outstanding at any time during 2014 or 2013 under our $2.25 billion revolving credit facility that

expires in October 2018.

Substantially all of our outstanding borrowings are senior, unsecured obligations. Most of our long-term debt obligations

contain covenants related to secured debt levels. In addition to a secured debt level covenant, our credit facility also

contains a debt leverage covenant. We are, and expect to remain, in compliance with these covenants, which have

no practical effect on our ability to pay dividends.

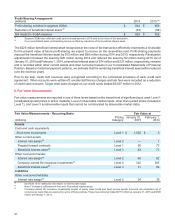

19. Derivative Financial Instruments

Our derivative instruments primarily consist of interest rate swaps, which are used to mitigate our interest rate risk. As

a result of our use of derivative instruments, we have counterparty credit exposure to large global financial institutions.

We monitor this concentration of counterparty credit risk on an ongoing basis. See Note 8 for a description of the fair

value measurement of our derivative instruments and their classification on the Consolidated Statements of Financial

Position.

In June 2014, we entered into two interest rate swaps, each with a notional amount of $500 million, under which we

pay a variable rate and receive a fixed rate. In March 2014, we entered into an interest rate swap with a notional

amount of $250 million, under which we pay a variable rate and receive a fixed rate. We designated these swaps as

fair value hedges. As of February 1, 2014, one swap was designated as a fair value hedge. No ineffectiveness was

recognized in 2014 or 2013.

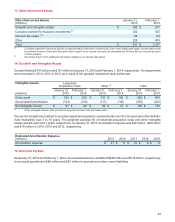

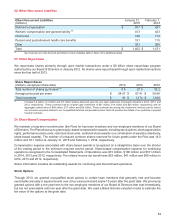

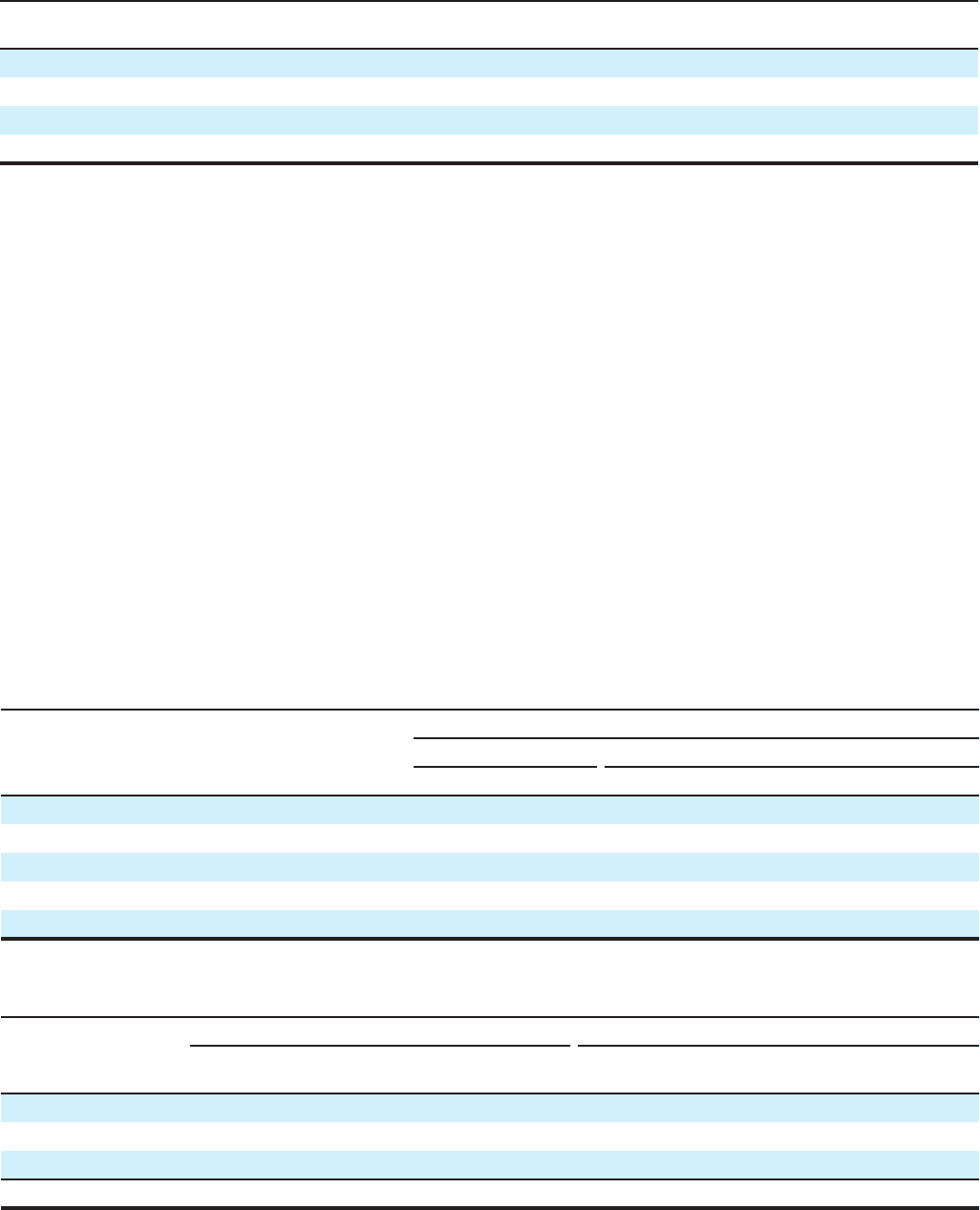

Outstanding Interest Rate Swap Summary

Designated

January 31, 2015

De-Designated

(dollars in millions) Pay Floating Pay Floating Pay Fixed

Weighted average rate:

Pay (a) 1-month LIBOR 3.8%

Receive 1.7% 5.7% 1-month LIBOR

Weighted average maturity 4.1 years 1.5 years 1.5 years

Notional $ 1,250 $ 500 $ 500

(a) There are three designated swaps at January 31, 2015. Two swaps have floating pay rates equal to 3-month LIBOR and one swap

has a floating pay rate equal to 1-month LIBOR.

Classification and Assets Liabilities

Fair Value Jan 31, Feb 1, Jan 31, Feb 1,

(millions) Classification 2015 2014 Classification 2015 2014

Designated: Other current assets $ — $ 1 N/A $ — $ —

Other noncurrent assets 27 — N/A — —

De-designated: Other noncurrent assets 38 62 Other noncurrent liabilities 24

Total $ 65 $ 63 $ 24 $ 39

48

39