Target 2014 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2014 Target annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

open during the liquidation. To assist with the exit plan, the Court approved the appointment of a monitor and certain

other financial advisors.

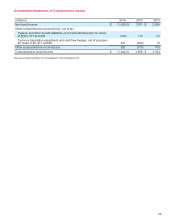

As a result of the Filing, we no longer have a controlling interest in the Canada Subsidiaries. For this reason, we

deconsolidated the Canada Subsidiaries effective January 15, 2015, which resulted in a pretax impairment loss on

deconsolidation and other charges, collectively totaling $5.1 billion. The pretax loss on deconsolidation includes the

derecognition of the carrying amounts of the Canada Subsidiaries' assets, liabilities and accumulated other

comprehensive loss and the recording of our remaining interests at fair value.

Subsequent to deconsolidation, we will use the cost method to account for our equity investment in the Canada

Subsidiaries, which has been reflected as zero in our Consolidated Statement of Financial Position at January 31,

2015 based on the estimated fair value of the Canada Subsidiaries' net assets. Loans to and accounts receivable from

the Canada Subsidiaries are recorded at an estimated fair value of $326 million.

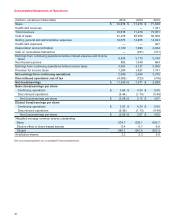

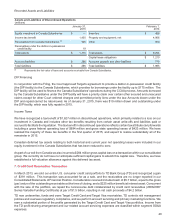

Loss on Discontinued Operations

Our Canadian exit represents a strategic shift in our business. For this reason, our Canadian Segment results for all

periods prior to the January 15, 2015 deconsolidation and costs to exit are classified as discontinued operations.

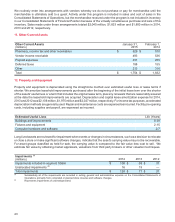

Loss on Discontinued Operations

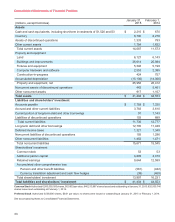

(millions) 2014 2013 2012

Sales $ 1,902 $ 1,317 $ —

Cost of sales 1,541 1,121 —

SG&A expenses

Depreciation and amortization

Interest expense

909

248

73

910

227

77

272

97

78

Pretax loss from operations (869) (1,018) (447)

Pretax exit costs

Income taxes

(5,105)

1,889

—

295

—

131

Loss on discontinued operations $ (4,085) $ (723) $ (316)

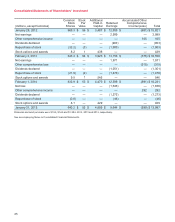

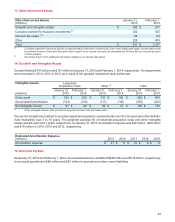

The fourth quarter Canadian pretax exit costs totaled $5,105 million and included the following:

Fourth Quarter Pretax Exit Costs

(millions) 2014

Investment impairment on deconsolidation

Contingent liabilities

Employee trust

Other exit costs

$ 4,766

240

73

26

Total $ 5,105

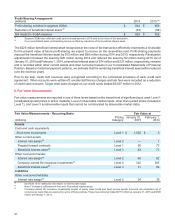

Investments in Canada Subsidiaries

Target continues to indirectly own 100% of the common stock of the Canada Subsidiaries, but has deconsolidated

those entities because Target no longer has a controlling interest. At the date of deconsolidation, we adjusted our

investment in the Canada Subsidiaries to fair value with a corresponding charge to income. Because the estimated

amount of the Canada Subsidiaries' liabilities exceeded the estimated fair value of the assets available for distribution

to its creditors, the fair value of Target’s equity investment approximates zero.

Target Corporation Amounts Receivable from Canada Subsidiaries

Prior to deconsolidation, Target Corporation made loans to the Canada Subsidiaries for the purpose of funding its

operations and had accounts receivable generated in the ordinary course of business. The loans, corresponding

interest and the accounts receivable were considered intercompany transactions and eliminated in the consolidated

Target Corporation financial statements. As of the deconsolidation date, the loans, associated interest and accounts

38