Target 2014 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2014 Target annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

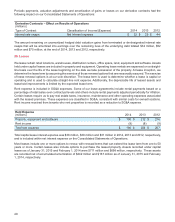

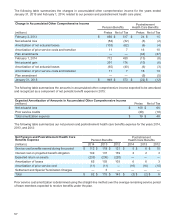

Defined Benefit Pension Plan Information

(millions) 2014 2013

Accumulated benefit obligation (ABO) for all plans (a) $ 3,834 $ 3,149

Projected benefit obligation for pension plans with an ABO in excess of plan assets (b) 65 54

Total ABO for pension plans with an ABO in excess of plan assets 56 48

(a) The present value of benefits earned to date assuming

no future salary growth.

(b) The present value of benefits earned to date by plan participants, including the effect of assumed future salary increases.

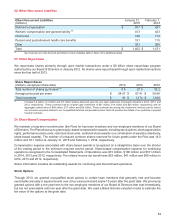

Assumptions

Benefit Obligation Weighted Average Assumptions

Pension Benefits

Postretirement

Health Care Benefits

2014 2013 2014 2013

Discount rate 3.87% 4.77% 2.74% 3.30%

Average assumed rate of compensation increase 3.00 3.00 n/a n/a

Net Periodic Benefit Expense Weighted Average

Assumptions Pension Benefits

Postretirement

Health Care Benefits

2014 2013 2012 2014 2013 2012

Discount rate 4.77% 4.40% 4.65% 3.30% 2.75% 3.60%

Expected long-term rate of return on plan assets 7.50 8.00 8.00 n/a n/a n/a

Average assumed rate of compensation increase 3.00 3.00 3.50 n/a n/a n/a

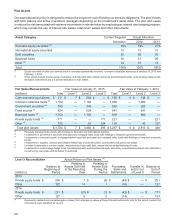

The weighted average assumptions used to measure net periodic benefit expense each year are the rates as of the

beginning of the year (i.e., the prior measurement date). Based on a stable asset allocation, our most recent compound

annual rate of return on qualified plans' assets was 12.1 percent, 8.3 percent, 7.0 percent and 9.7 percent for the 5-

year, 10-year, 15-year and 20-year time periods, respectively.

The market-related value of plan assets, which is used in calculating expected return on assets in net periodic benefit

cost, is determined each year by adjusting the previous year's value by expected return, benefit payments and cash

contributions. The market-related value is adjusted for asset gains and losses in equal 20 percent adjustments over

a five-year period.

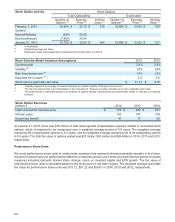

We review the expected long-term rate of return annually, and revise it as appropriate. Additionally, we monitor the

mix of investments in our portfolio to ensure alignment with our long-term strategy to manage pension cost and reduce

volatility in our assets. Our expected annualized long-term rate of return assumptions as of January 31, 2015 were

8.0 percent for domestic and international equity securities, 5.0 percent for long-duration debt securities, 8.0 percent

for balanced funds and 9.5 percent for other investments. These estimates are a judgmental matter in which we

consider the composition of our asset portfolio, our historical long-term investment performance and current market

conditions.

An increase in the cost of covered health care benefits of 7.0 percent was assumed for 2014 and 7.0 percent is assumed

for 2015. The rate will be reduced to 5.0 percent in 2019 and thereafter.

Health Care Cost Trend Rates – 1% Change

(millions) 1% Increase 1% Decrease

Effect on total of service and interest cost components of net periodic postretirement

health care benefit expense $ 1 $ (1)

Effect on the health care component of the accumulated postretirement benefit

obligation 4 (4)

58