Cabela's 2014 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2014 Cabela's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

107

CABELA’S INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in Thousands Except Share and Per Share Amounts)

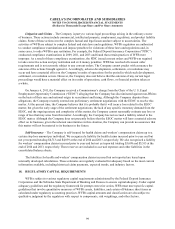

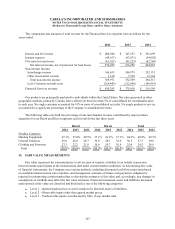

The components and amounts of total revenue for the Financial Services segment were as follows for the

years ended:

2014 2013 2012

Interest and fee income $ 400,948 $ 343,353 $ 301,699

Interest expense (64,167) (63,831) (54,092)

Provision for loan losses (61,922) (43,223) (42,760)

Net interest income, net of provision for loan losses 274,859 236,299 204,847

Non-interest income:

Interchange income 366,633 344,979 292,151

Other non-interest income 3,338 7,530 12,364

Total non-interest income 369,971 352,509 304,515

Less: Customer rewards costs (214,445) (212,998) (189,963)

Financial Services revenue $ 430,385 $ 375,810 $ 319,399

Our products are principally marketed to individuals within the United States. Net sales generated in other

geographic markets, primarily Canada, have collectively been less than 5% of consolidated net merchandise sales

in each year. No single customer accounted for 10% or more of consolidated net sales. No single product or service

accounted for a significant percentage of the Company’s consolidated revenue.

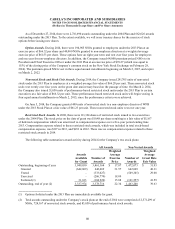

The following table sets forth the percentage of our merchandise revenue contributed by major product

categories for our Retail and Direct segments and in total for the last three years.

Retail Direct Total

2014 2013 2012 2014 2013 2012 2014 2013 2012

Product Category:

Hunting Equipment 47.1% 51.0% 49.5% 37.1% 41.2% 37.1% 44.3% 48.0% 45.3%

General Outdoors 29.6 26.8 28.7 32.0 29.1 32.0 30.3 27.5 29.8

Clothing and Footwear 23.3 22.2 21.8 30.9 29.7 30.9 25.4 24.5 24.9

Total 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0%

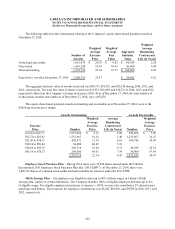

24. FAIR VALUE MEASUREMENTS

Fair value represents the estimated price to sell an asset or transfer a liability in an orderly transaction

between market participants at the measurement date under current market conditions. In determining fair value

of financial instruments, the Company uses various methods, including discounted cash flow projections based

on available market interest rates and data, and management estimates of future cash payments. Judgment is

required in interpreting certain market data to develop the estimates of fair value and, accordingly, any changes in

assumptions or methods may affect the fair value estimates. Financial instrument assets and liabilities measured

and reported at fair value are classified and disclosed in one of the following categories:

x Level 1 – Quoted market prices in active markets for identical assets or liabilities.

x Level 2 – Observable inputs other than quoted market prices.

x Level 3 – Unobservable inputs corroborated by little, if any, market data.