Cabela's 2014 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2014 Cabela's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

68

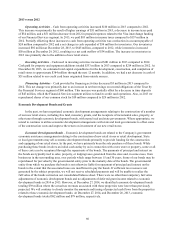

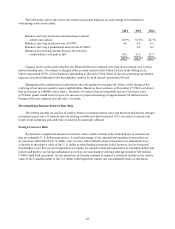

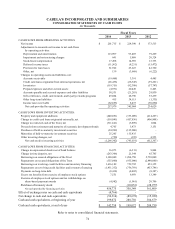

The table below shows the mix of our credit card account balances as a percentage of total balances

outstanding at the years ended:

2014 2013 2012

Balances carrying an interest rate based upon various

interest rate indices 65.9% 63.8% 62.3%

Balances carrying an interest rate of 9.99% 4.6 4.5 4.2

Balances carrying a promotional interest rate of 0.00% - 0.2 0.2

Balances not carrying interest because the previous

month balance was paid in full 29.5 31.5 33.3

100.0% 100.0% 100.0%

Charges on the credit cards issued by the Financial Services segment were priced at a margin over various

defined lending rates. No interest is charged if the account is paid in full within 25 days of the billing cycle,

which represented 29.5% of total balances outstanding at the end of 2014. Some of the zero percentage promotion

expenses are passed through to the merchandise vendors for each specific promotion offered.

Management has performed several interest rate risk analyses to measure the effects of the timing of the

repricing of our interest sensitive assets and liabilities. Based on these analyses, at December 27, 2014, we believe

that an increase in LIBOR is more likely. Therefore, we believe that an immediate increase in interest rates

of 50 basis points would result in a pre-tax increase to projected earnings of approximately $8 million for the

Financial Services segment over the next 12 months.

Merchandising Business Interest Rate Risk

The interest payable on our line of credit is based on variable interest rates and therefore affected by changes

in market interest rates. If interest rates on existing variable rate debt increased 1.0%, our interest expense and

results from operations and cash flows would not be materially affected.

Foreign Currency Risk

We purchase a significant amount of inventory from vendors outside of the United States in transactions

that are primarily U. S. dollar transactions. A small percentage of our international purchase transactions are

in currencies other than the U. S. dollar. Any currency risks related to these transactions are immaterial to us.

A decline in the relative value of the U. S. dollar to other foreign currencies could, however, lead to increased

merchandise costs. For our retail operations in Canada, we intend to fund all transactions in Canadian dollars and

utilize cash held by our foreign subsidiaries as well as our unsecured revolving credit agreement of $20 million

CAD to fund such operations. As our operations in Canada continue to expand, a sustained decline in the relative

value of the Canadian dollar to the U.S. dollar could negatively impact our consolidated results of operations.