Coca Cola 2014 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2014 Coca Cola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

116

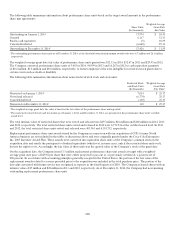

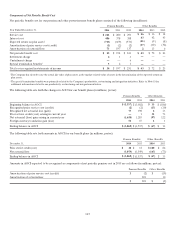

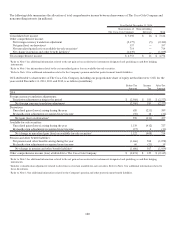

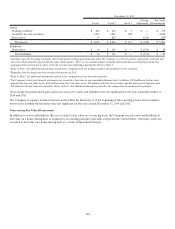

A reconciliation of the statutory U.S. federal tax rate and our effective tax rate is as follows:

Year Ended December 31, 2014 2013 2012

Statutory U.S. federal tax rate 35.0% 35.0% 35.0%

State and local income taxes — net of federal benefit 1.0 1.0 1.1

Earnings in jurisdictions taxed at rates different from the statutory U.S. federal rate (11.5)

1,2

(10.3)5,

6,7

(9.5)

10,11

Reversal of valuation allowances —— (2.4)12

Equity income or loss

(2.2)

(1.4)8(2.0)

Other operating charges 2.93,4 1.29

0.4

13

Other — net

(1.6

)(0.7)

0.5

Effective tax rate

23.6

%24.8%

23.1

%

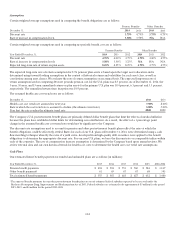

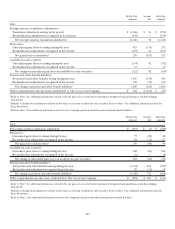

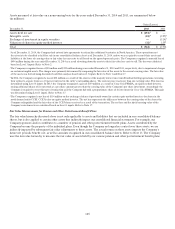

1 Includes a $6 million tax expense on a pretax net charge of $372 million (or a 1.5 percent impact on our effective tax rate) due to the remeasurement of

the net monetary assets of our local Venezuelan subsidiary into U.S. dollars using the SICAD 2 exchange rate. Refer to Note 1.

2 Includes a tax expense of $18 million (or a 0.2 percent impact on our effective tax rate) related to amounts required to be recorded for changes to our

uncertain tax positions, including interest and penalties, in various international jurisdictions.

3 Includes a tax expense of $55 million on a pretax charge of $352 million (or a 1.9 percent impact on our effective tax rate) primarily due to an impairment

of a Venezuelan trademark, a write-down the Company recorded on the concentrate sales receivables from our bottling partner in Venezuela, a charge

associated with certain of the Company’s fixed assets, and as a result of the restructuring and transition of the Company’s Russian juice operations to an

existing joint venture with an unconsolidated bottling partner. Refer to Note 1 and Note 17.

4 Includes a tax benefit of $191 million on pretax charges of $809 million (or a 1 percent impact on our effective tax rate) primarily related to the

Company’s productivity and reinvestment program as well as other restructuring initiatives. Refer to Note 18.

5 Includes a tax benefit of $26 million (or a 0.2 percent impact on our effective tax rate) related to amounts required to be recorded for changes to our

uncertain tax positions, including interest and penalties, in various international jurisdictions.

6 Includes a tax expense of $279 million on pretax net gains of $501 million (or a 0.9 percent impact on our effective tax rate) related to the

deconsolidation of our Brazilian bottling operations upon their combination with an independent bottler and a loss due to the merger of four of the

Company’s Japanese bottling partners. Refer to Note 2 and Note 17.

7 Includes a tax expense of $3 million (or a 0.5 percent impact on our effective tax rate) related to a charge of $149 million due to the devaluation of the

Venezuelan bolivar. Refer to Note 19.

8 Includes an $8 million tax benefit on a pretax charge of $159 million (or a 0.4 percent impact on our effective tax rate) related to our proportionate share

of unusual or infrequent items recorded by our equity method investees. Refer to Note 17.

9 Includes a tax benefit of $175 million on pretax charges of $877 million (or a 1.2 percent impact on our effective tax rate) primarily related to impairment

charges recorded on certain of the Company’s intangible assets and charges related to the Company’s productivity and reinvestment program as well as

other restructuring initiatives. Refer to Note 17 and Note 18.

10 Includes a tax expense of $133 million (or a 1.1 percent impact on our effective tax rate) related to amounts required to be recorded for changes to our

uncertain tax positions, including interest and penalties, in various international jurisdictions.

11 Includes a tax expense of $57 million on pretax net gains of $76 million (or a 0.3 percent impact on our effective tax rate) related to the following: a gain

recognized as a result of the merger of Embotelladora Andina S.A. (“Andina”) and Embotelladoras Coca-Cola Polar S.A. (“Polar”); a gain recognized as

a result of Coca-Cola FEMSA, an equity method investee, issuing additional shares of its own stock at a per share amount greater than the carrying value

of the Company’s per share investment; the loss recognized on the then pending sale of a majority ownership interest in our consolidated Philippine

bottling operations to Coca-Cola FEMSA; and the expense recorded for the premium the Company paid over the publicly traded market price to acquire

an ownership interest in Mikuni. Refer to Note 17.

12 Relates to a net tax benefit of $283 million associated with the reversal of valuation allowances in certain of the Company’s foreign jurisdictions.

13 Includes a tax benefit of $95 million on pretax charges of $416 million (or a 0.4 percent impact on our effective tax rate) primarily related to the

Company’s productivity and reinvestment program as well as other restructuring initiatives; the refinement of previously established accruals related to

the Company’s 2008–2011 productivity initiatives; and the refinement of previously established accruals related to the Company’s integration of CCE’s

former North America business. Refer to Note 18.