Coca Cola 2014 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2014 Coca Cola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

39

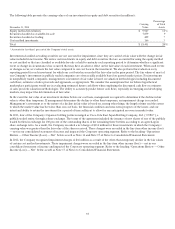

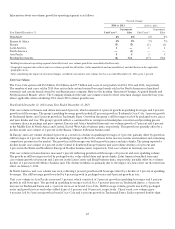

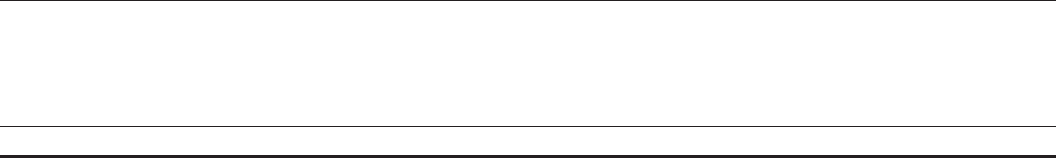

The following table presents the carrying values of intangible assets included in our consolidated balance sheet (in millions):

December 31, 2014

Carrying

V

alue

P

ercentage

of T

otal

Assets

1

Goodwill $

12,100

13%

Bottlers’ franchise rights with indefinite

lives

6,689

7

Trademarks with indefinite

lives

6,533

7

Definite-lived intangible assets,

net

880

1

Other intangible assets not subject to

amortization

170 *

T

otal

$

26,372

29%

* Accounts for less than 1 percent of the Company’s total assets.

1 The total percentage does not add due to rounding.

When facts and circumstances indicate that the carrying value of definite-lived intangible assets may not be recoverable, management

assesses the recoverability of the carrying value by preparing estimates of sales volume and the resulting gross profit and cash flows.

These estimated future cash flows are consistent with those we use in our internal planning. If the sum of the expected future cash

flows (undiscounted and without interest charges) is less than the carrying amount of the asset (or asset group), we recognize an

impairment loss. The impairment loss recognized is the amount by which the carrying amount exceeds the fair value. We use a variety

of methodologies to determine the fair value of these assets, including discounted cash flow models, which are consistent with the

assumptions we believe hypothetical marketplace participants would use.

We test intangible assets determined to have indefinite useful lives, including trademarks, franchise rights and goodwill, for

impairment annually, or more frequently if events or circumstances indicate that assets might be impaired. Our Company performs

these annual impairment reviews as of the first day of our third fiscal quarter. We use a variety of methodologies in conducting

impairment assessments of indefinite-lived intangible assets, including, but not limited to, discounted cash flow models, which are

based on the assumptions we believe hypothetical marketplace participants would use. For indefinite-lived intangible assets, other than

goodwill, if the carrying amount exceeds the fair value, an impairment charge is recognized in an amount equal to that excess.

The Company has the option to perform a qualitative assessment of indefinite-lived intangible assets, other than goodwill, prior to

completing the impairment test described above. The Company must assess whether it is more likely than not that the fair value of the

intangible asset is less than its carrying amount. If the Company concludes that this is the case, it must perform the testing described

above. Otherwise, the Company does not need to perform any further assessment. During 2014, the Company performed qualitative

assessments on less than 10 percent of our indefinite-lived intangible assets balance.

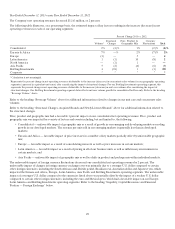

We perform impairment tests of goodwill at our reporting unit level, which is one level below our operating segments. Our operating

segments are primarily based on geographic responsibility, which is consistent with the way management runs our business. Our

operating segments are subdivided into smaller geographic regions or territories that we sometimes refer to as “business units”. These

business units are also our reporting units. The Bottling Investments operating segment includes all Company-owned or consolidated

bottling operations, regardless of geographic location, except for bottling operations managed by CCR, which are included in

our North America operating segment. Generally, each Company-owned or consolidated bottling operation within our Bottling

Investments operating segment is its own reporting unit. Goodwill is assigned to the reporting unit or units that benefit from the

synergies arising from each business combination.

The goodwill impairment test consists of a two-step process, if necessary. The first step is to compare the fair value of a reporting

unit to its carrying value, including goodwill. We typically use discounted cash flow models to determine the fair value of a reporting

unit. The assumptions used in these models are consistent with those we believe hypothetical marketplace participants would use. If

the fair value of the reporting unit is less than its carrying value, the second step of the impairment test must be performed in order

to determine the amount of impairment loss, if any. The second step compares the implied fair value of the reporting unit’s goodwill

with the carrying amount of that goodwill. If the carrying amount of the reporting unit’s goodwill exceeds its implied fair value,

an impairment charge is recognized in an amount equal to that excess. The loss recognized cannot exceed the carrying amount of

goodwill.

The Company has the option to perform a qualitative assessment of goodwill prior to completing the two-step process

described above to determine whether it is more likely than not that the fair value of a reporting unit is less than its carrying

amount, including goodwill and other intangible assets. If the Company concludes that this is the case, it must perform the two-