Proctor and Gamble 2013 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2013 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Procter & Gamble Company 39

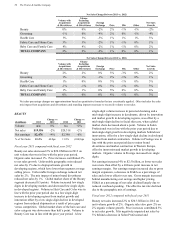

Contractual Commitments

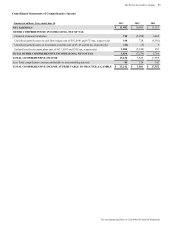

The following table provides information on the amount and payable date of our contractual commitments as of June 30, 2013.

($ millions) Total

Less Than

1 Year 1-3 Years 3-5 Years

After

5 Years

RECORDED LIABILITIES

Total debt $ 31,441 $ 12,393 $ 6,004 $ 2,609 $ 10,435

Capital leases 31 518 8—

Uncertain tax positions(1) 46 46———

OTHER

Interest payments relating to long-term debt 8,220 865 1,382 1,169 4,804

Operating leases(2) 1,512 254 437 302 519

Minimum pension funding(3) 722 263 459 — —

Purchase obligations(4) 2,183 1,114 625 210 234

TOTAL CONTRACTUAL COMMITMENTS 44,155 14,940 8,925 4,298 15,992

(1) As of June 30, 2013, the Company's Consolidated Balance Sheet reflects a liability for uncertain tax positions of $2.0 billion, including

$447 million of interest and penalties. Due to the high degree of uncertainty regarding the timing of future cash outflows of liabilities for

uncertain tax positions beyond one year, a reasonable estimate of the period of cash settlement beyond twelve months from the balance

sheet date of June 30, 2013, cannot be made.

(2) Operating lease obligations are shown net of guaranteed sublease income.

(3) Represents future pension payments to comply with local funding requirements. These future pension payments assume the Company

continues to meet its future statutory funding requirements. These amounts do not include expected future discretionary contributions,

including the July 2013 contribution to a foreign pension plan of approximately $1 billion. Considering the current economic

environment in which the Company operates, the Company believes its cash flows are adequate to meet the future statutory funding

requirements. The projected payments beyond fiscal year 2016 are not currently determinable.

(4) Primarily reflects future contractual payments under various take-or-pay arrangements entered into as part of the normal course of

business. Commitments made under take-or-pay obligations represent future purchases in line with expected usage to obtain favorable

pricing. Approximately 20% relates to service contracts for information technology, human resources management and facilities

management activities that have been outsourced. While the amounts listed represent contractual obligations, we do not believe it is

likely that the full contractual amount would be paid if the underlying contracts were canceled prior to maturity. In such cases, we

generally are able to negotiate new contracts or cancellation penalties, resulting in a reduced payment. The amounts do not include other

contractual purchase obligations that are not take-or-pay arrangements. Such contractual purchase obligations are primarily purchase

orders at fair value that are part of normal operations and are reflected in historical operating cash flow trends. We do not believe such

purchase obligations will adversely affect our liquidity position.

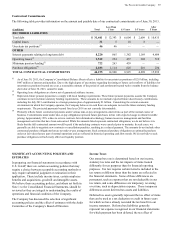

SIGNIFICANT ACCOUNTING POLICIES AND

ESTIMATES

In preparing our financial statements in accordance with

U.S. GAAP, there are certain accounting policies that may

require a choice between acceptable accounting methods or

may require substantial judgment or estimation in their

application. These include income taxes, certain employee

benefits and acquisitions, goodwill and intangible assets.

We believe these accounting policies, and others set forth in

Note 1 to the Consolidated Financial Statements, should be

reviewed as they are integral to understanding the results of

operations and financial condition of the Company.

The Company has discussed the selection of significant

accounting policies and the effect of estimates with the Audit

Committee of the Company's Board of Directors.

Income Taxes

Our annual tax rate is determined based on our income,

statutory tax rates and the tax impacts of items treated

differently for tax purposes than for financial reporting

purposes. Tax law requires certain items be included in the

tax return at different times than the items are reflected in

the financial statements. Some of these differences are

permanent, such as expenses that are not deductible in our

tax return, and some differences are temporary, reversing

over time, such as depreciation expense. These temporary

differences create deferred tax assets and liabilities.

Deferred tax assets generally represent the tax effect of items

that can be used as a tax deduction or credit in future years

for which we have already recorded the tax benefit in our

income statement. Deferred tax liabilities generally

represent tax expense recognized in our financial statements

for which payment has been deferred, the tax effect of