Proctor and Gamble 2013 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2013 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

66 The Procter & Gamble Company

Amounts in millions of dollars except per share amounts or as otherwise specified.

reduces our cash contribution required to fund the U.S. DC

plan.

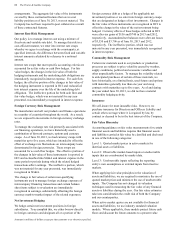

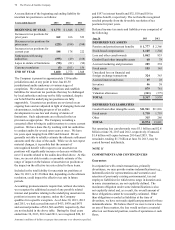

Defined Benefit Retirement Plans and Other Retiree Benefits

We offer defined benefit retirement pension plans to certain employees. These benefits relate primarily to local plans outside

the U.S. and, to a lesser extent, plans assumed in previous acquisitions covering U.S. employees.

We also provide certain other retiree benefits, primarily health care and life insurance, for the majority of our U.S. employees

who become eligible for these benefits when they meet minimum age and service requirements. Generally, the health care plans

require cost sharing with retirees and pay a stated percentage of expenses, reduced by deductibles and other coverages. These

benefits are primarily funded by ESOP Series B shares and certain other assets contributed by the Company.

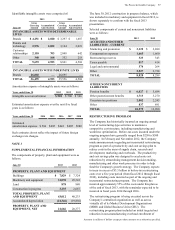

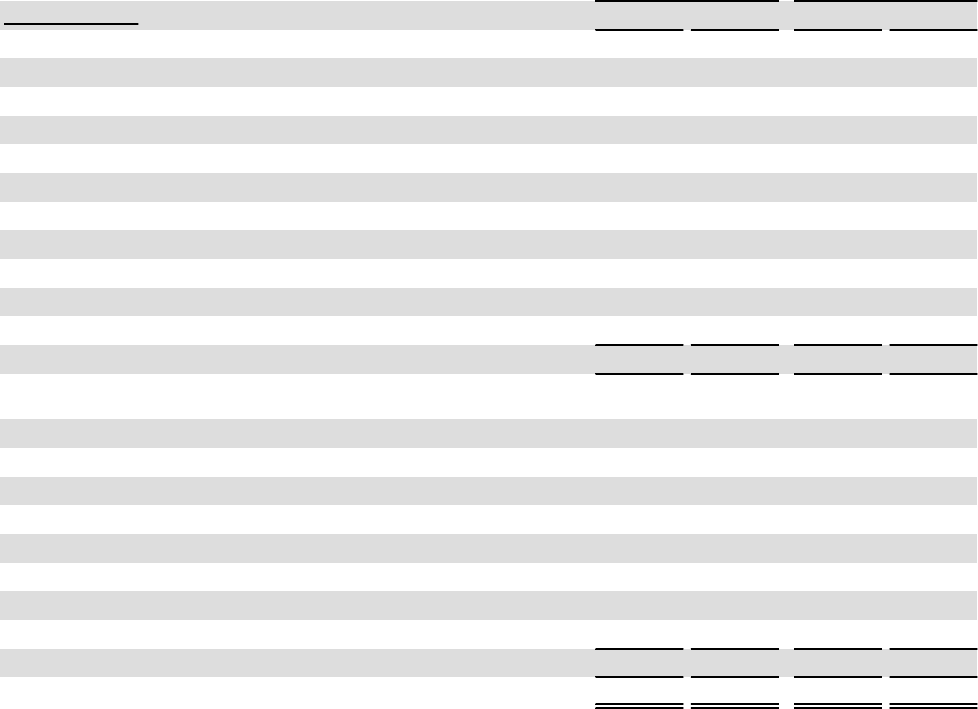

Obligation and Funded Status.The following provides a reconciliation of benefit obligations, plan assets and funded status of

these defined benefit plans:

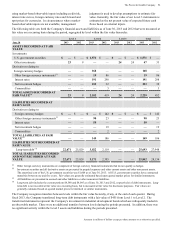

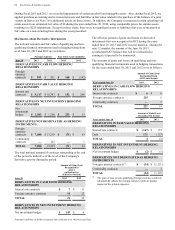

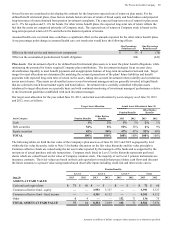

Pension Benefits(1) Other Retiree Benefits(2)

Years ended June 30 2013 2012 2013 2012

CHANGE IN BENEFIT OBLIGATION

Benefit obligation at beginning of year(3) $ 13,573 $ 12,229 $ 6,006 $ 4,886

Service cost 300 267 190 142

Interest cost 560 611 260 276

Participants' contributions 20 22 66 68

Amendments 104 (44)——

Actuarial loss/(gain) 473 1,911 (1,022)957

Acquisitions/(divestitures) 51 (17)——

Special termination benefits 39 —18 27

Currency translation and other (4)(847)5(95)

Benefit payments (602)(559)(234)(255)

BENEFIT OBLIGATION AT END OF YEAR(3) 14,514 13,573 5,289 6,006

CHANGE IN PLAN ASSETS

Fair value of plan assets at beginning of year 7,974 7,962 2,713 2,975

Actual return on plan assets 796 459 954 (126)

Acquisitions/(divestitures) 59 ———

Employer contributions 391 485 23 24

Participants' contributions 20 22 66 68

Currency translation and other (77)(395)——

ESOP debt impacts(4) ——31 27

Benefit payments (602)(559)(234)(255)

FAIR VALUE OF PLAN ASSETS AT END OF YEAR 8,561 7,974 3,553 2,713

FUNDED STATUS (5,953)(5,599)(1,736)(3,293)

(1) Primarily non-U.S.-based defined benefit retirement plans.

(2) Primarily U.S.-based other postretirement benefit plans.

(3) For the pension benefit plans, the benefit obligation is the projected benefit obligation. For other retiree benefit plans, the benefit

obligation is the accumulated postretirement benefit obligation.

(4) Represents the net impact of ESOP debt service requirements, which is netted against plan assets for other retiree benefits.

The underfunding of pension benefits is primarily a function of the different funding incentives that exist outside of the U.S. In

certain countries, there are no legal requirements or financial incentives provided to companies to pre-fund pension obligations

prior to their due date. In these instances, benefit payments are typically paid directly from the Company's cash as they become

due.