Proctor and Gamble 2013 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2013 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Procter & Gamble Company 59

Amounts in millions of dollars except per share amounts or as otherwise specified.

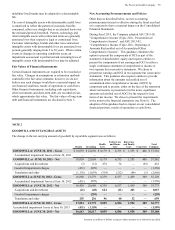

NOTE 4

SHORT-TERM AND LONG-TERM DEBT

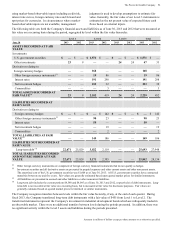

June 30 2013 2012

DEBT DUE WITHIN ONE YEAR

Current portion of long-term debt $ 4,506 $ 4,083

Commercial paper 7,642 4,574

Other 284 41

TOTAL 12,432 8,698

Short-term weighted average interest

rates(1) 0.5% 0.6%

(1) Weighted average short-term interest rates include the effects of

interest rate swaps discussed in Note 5.

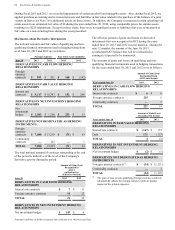

June 30 2013 2012

LONG-TERM DEBT

Floating rate USD notes due February

2014 $ 2,000 $ 1,000

4.50% EUR note due May 2014 1,960 1,887

4.95% USD note due August 2014 900 900

0.70% USD note due August 2014 1,000 1,000

3.50% USD note due February 2015 750 750

0.95% JPY note due May 2015 1,012 1,261

3.15% USD note due September 2015 500 500

1.80% USD note due November 2015 1,000 1,000

4.85% USD note due December 2015 700 700

1.45% USD note due August 2016 1,000 1,000

5.13% EUR note due October 2017 1,437 1,383

4.70% USD note due February 2019 1,250 1,250

4.13% EUR note due December 2020 784 755

9.36% ESOP debentures due

2013-2021(1) 701 757

2.30% USD note due February 2022 1,000 1,000

2.00% EUR note due August 2022 1,307 —

4.88% EUR note due May 2027 1,307 1,258

6.25% GBP note due January 2030 764 780

5.50% USD note due February 2034 500 500

5.80% USD note due August 2034 600 600

5.55% USD note due March 2037 1,400 1,400

Capital lease obligations 31 45

All other long-term debt 1,714 5,437

Current portion of long-term debt (4,506) (4,083)

TOTAL 19,111 21,080

Long-term weighted average interest

rates(2) 3.3% 3.3%

(1) Debt issued by the ESOP is guaranteed by the Company and

must be recorded as debt of the Company as discussed in Note 9.

(2) Weighted average long-term interest rates include the effects of

interest rate swaps discussed in Note 5.

Long-term debt maturities during the next five fiscal years are

as follows:

June 30 2014 2015 2016 2017 2018

Debt maturities $4,506 $3,798 $2,379 $1,085 $ 1,531

The Procter & Gamble Company fully and unconditionally

guarantees the registered debt and securities issued by its

100% finance subsidiaries.

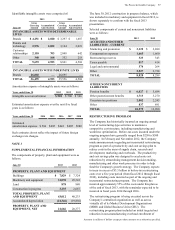

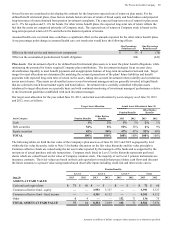

NOTE 5

RISK MANAGEMENT ACTIVITIES AND FAIR

VALUE MEASUREMENTS

As a multinational company with diverse product offerings,

we are exposed to market risks, such as changes in interest

rates, currency exchange rates and commodity prices. We

evaluate exposures on a centralized basis to take advantage

of natural exposure correlation and netting. To the extent we

choose to manage volatility associated with the net

exposures, we enter into various financial transactions that

we account for using the applicable accounting guidance for

derivative instruments and hedging activities. These

financial transactions are governed by our policies covering

acceptable counterparty exposure, instrument types and

other hedging practices.

At inception, we formally designate and document

qualifying instruments as hedges of underlying exposures.

We formally assess, at inception and at least quarterly,

whether the financial instruments used in hedging

transactions are effective at offsetting changes in either the

fair value or cash flows of the related underlying exposures.

Fluctuations in the value of these instruments generally are

offset by changes in the value or cash flows of the

underlying exposures being hedged. This is driven by the

high degree of effectiveness between the exposure being

hedged and the hedging instrument. The ineffective portion

of a change in the fair value of a qualifying instrument is

immediately recognized in earnings. The amount of

ineffectiveness recognized was immaterial for all years

presented.

Credit Risk Management

We have counterparty credit guidelines and normally enter

into transactions with investment grade financial institutions.

Counterparty exposures are monitored daily and downgrades

in counterparty credit ratings are reviewed on a timely basis.

We have not incurred, and do not expect to incur, material

credit losses on our risk management or other financial

instruments.

Certain of the Company's financial instruments used in

hedging transactions are governed by industry standard

netting and collateral agreements with counterparties. If the

Company's credit rating were to fall below the levels

stipulated in the agreements, the counterparties could

demand either collateralization or termination of the