Proctor and Gamble 2013 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2013 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The Procter & Gamble Company 53

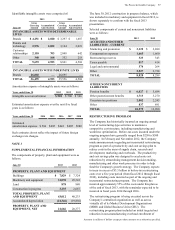

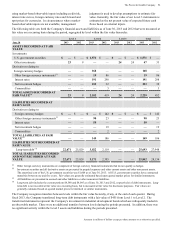

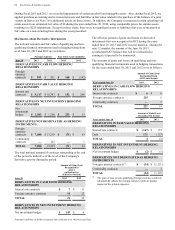

Amounts in millions of dollars except per share amounts or as otherwise specified.

Notes to Consolidated Financial Statements

NOTE 1

SUMMARY OF SIGNIFICANT ACCOUNTING

POLICIES

Nature of Operations

The Procter & Gamble Company's (the "Company," "Procter

& Gamble," "we" or "us") business is focused on providing

branded consumer packaged goods of superior quality and

value. Our products are sold in more than 180 countries and

territories primarily through retail operations including mass

merchandisers, grocery stores, membership club stores, drug

stores, department stores, salons, high-frequency stores and

e-commerce. We have on-the-ground operations in

approximately 70 countries.

Basis of Presentation

The Consolidated Financial Statements include the

Company and its controlled subsidiaries. Intercompany

transactions are eliminated.

Use of Estimates

Preparation of financial statements in conformity with

accounting principles generally accepted in the United States

of America (U.S. GAAP) requires management to make

estimates and assumptions that affect the amounts reported

in the Consolidated Financial Statements and accompanying

disclosures. These estimates are based on management's

best knowledge of current events and actions the Company

may undertake in the future. Estimates are used in

accounting for, among other items, consumer and trade

promotion accruals, restructuring reserves, pensions, post-

employment benefits, stock options, valuation of acquired

intangible assets, useful lives for depreciation and

amortization of long-lived assets, future cash flows

associated with impairment testing for goodwill, indefinite-

lived intangible assets and other long-lived assets, deferred

tax assets, uncertain income tax positions and contingencies.

Actual results may ultimately differ from estimates, although

management does not generally believe such differences

would materially affect the financial statements in any

individual year. However, in regard to ongoing impairment

testing of goodwill and indefinite-lived intangible assets,

significant deterioration in future cash flow projections or

other assumptions used in estimating fair values versus those

anticipated at the time of the initial valuations, could result

in impairment charges that materially affect the financial

statements in a given year.

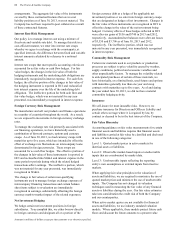

Revenue Recognition

Sales are recognized when revenue is realized or realizable

and has been earned. Revenue transactions represent sales

of inventory. The revenue recorded is presented net of sales

and other taxes we collect on behalf of governmental

authorities. The revenue includes shipping and handling

costs, which generally are included in the list price to the

customer. Our policy is to recognize revenue when title to

the product, ownership and risk of loss transfer to the

customer, which can be on the date of shipment or the date

of receipt by the customer. A provision for payment

discounts and product return allowances is recorded as a

reduction of sales in the same period that the revenue is

recognized.

Trade promotions, consisting primarily of customer pricing

allowances, merchandising funds and consumer coupons, are

offered through various programs to customers and

consumers. Sales are recorded net of trade promotion

spending, which is recognized as incurred, generally at the

time of the sale. Most of these arrangements have terms of

approximately one year. Accruals for expected payouts

under these programs are included as accrued marketing and

promotion in the accrued and other liabilities line item in the

Consolidated Balance Sheets.

Cost of Products Sold

Cost of products sold is primarily comprised of direct

materials and supplies consumed in the manufacture of

product, as well as manufacturing labor, depreciation

expense and direct overhead expense necessary to acquire

and convert the purchased materials and supplies into

finished product. Cost of products sold also includes the

cost to distribute products to customers, inbound freight

costs, internal transfer costs, warehousing costs and other

shipping and handling activity.

Selling, General and Administrative Expense

Selling, general and administrative expense (SG&A) is

primarily comprised of marketing expenses, selling

expenses, research and development costs, administrative

and other indirect overhead costs, depreciation and

amortization expense on non-manufacturing assets and other

miscellaneous operating items. Research and development

costs are charged to expense as incurred and were $2.0

billion in 2013, 2012 and 2011. Advertising costs, charged

to expense as incurred, include worldwide television, print,

radio, internet and in-store advertising expenses and were

$9.7 billion in 2013, $9.3 billion in 2012 and $9.2 billion in

2011. Non-advertising related components of the

Company's total marketing spending include costs associated

with consumer promotions, product sampling and sales aids,

which are included in SG&A, as well as coupons and

customer trade funds, which are recorded as reductions to

net sales.

Other Non-Operating Income, Net

Other non-operating income, net, primarily includes net

acquisition and divestiture gains and investment income.