Humana 2002 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2002 Humana annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Humana Inc.

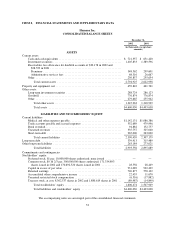

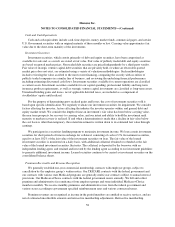

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

1. REPORTING ENTITY

Nature of Operations

Headquartered in Louisville, Kentucky, Humana Inc. is one of the nation’s largest publicly traded health

benefits companies, based on our 2002 revenues of $11.3 billion. References throughout this document to “we,”

“us,” “our,” “Company,” and “Humana,” mean Humana Inc. and all entities we own. We offer coordinated

health insurance coverage and related services through a variety of traditional and Internet-based plans for

employer groups, government-sponsored programs, and individuals. In 2002, approximately 70% of our

premiums and administrative services fees resulted from members located in Florida, Illinois, Texas, Kentucky

and Ohio. We derived approximately 44% of our premiums and administrative services fees from contracts with

the federal government in 2002. Under two federal government contracts with the Department of Defense, we

provide health insurance coverage to TRICARE members, accounting for approximately 19% of our total

premium and administrative services fees in 2002. Under one federal government contract with the Centers for

Medicare and Medicaid Services, or CMS, we provide health insurance coverage for Medicare+Choice members

in Florida, accounting for approximately 16% of our total premiums and administrative services fees in 2002.

We manage our business with two segments: Commercial and Government. The Commercial segment

consists of members enrolled in products marketed to employer groups and individuals, and includes three lines

of business: fully insured medical, administrative services only, or ASO, and specialty. The Government segment

consists of members enrolled in government-sponsored programs, and includes three lines of business:

Medicare+Choice, Medicaid, and TRICARE. We identified our segments in accordance with the aggregation

provisions of Statement of Financial Accounting Standards No. 131, Disclosures About Segments of an

Enterprise and Related Information which is consistent with information used by our Chief Executive Officer in

managing our business. The segment information aggregates products with similar economic characteristics.

These characteristics include the nature of customer groups and pricing, benefits and underwriting requirements.

The results of each segment are measured by income before income taxes. We allocate all selling, general

and administrative expenses, investment and other income, interest expense, and goodwill, but no other assets or

liabilities, to our segments. Members served by our two segments generally utilize the same medical provider

networks, enabling us to obtain more favorable contract terms with providers. Our segments also share overhead

costs and assets. As a result, the profitability of each segment is interdependent.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

Our financial statements and accompanying notes are prepared in accordance with accounting principles

generally accepted in the United States of America. Our consolidated financial statements include the accounts of

Humana Inc., and its majority-owned subsidiaries. All significant intercompany balances and transactions have

been eliminated. Certain reclassifications have been made to our prior years’ consolidated financial statements to

conform with the current year presentation. These adjustments had no effect on previously reported consolidated

net income or stockholders’ equity.

The preparation of financial statements in accordance with generally accepted accounting principles requires

us to make estimates and assumptions that affect the amounts reported in the financial statements and

accompanying notes. The areas involving the most significant use of estimates are the estimation of medical

expenses payable, the recognition of revenue related to our TRICARE contracts, the valuation and related

impairment recognition of investment securities, and the valuation and related impairment recognition of long-

lived assets, including goodwill. These estimates are based on knowledge of current events and anticipated future

events, and accordingly, actual results may ultimately differ materially from those estimates.

57