Yahoo 2007 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2007 Yahoo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.the agreement. Agreements with fixed payments are expensed ratably over the term the fixed payment covers.

Agreements based on a percentage of revenue, number of paid introductions, number of searches, or other metrics

are expensed based on the volume of the underlying activity or revenue multiplied by the agreed-upon price or rate.

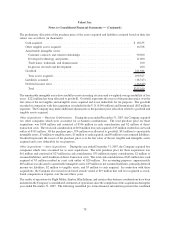

Product Development. Product development expenses consist primarily of compensation related expenses

(including stock-based compensation expense) incurred for the development of, minor enhancements to, and

maintenance of Yahoo! Properties, classification and organization of listings within Yahoo! Properties, research and

development, and Yahoo!’s technology platforms and infrastructure. Depreciation expense and other operating

costs are also included in product development.

Advertising Costs. Advertising production costs are recorded as expense the first time an advertisement appears.

Costs of communicating advertising are recorded as expense as advertising space or airtime is used. All other

advertising costs are expensed as incurred. Advertising expense totaled approximately $201 million, $222 million,

and $220 million for 2005, 2006, and 2007, respectively.

Stock-Based Compensation. Prior to January 1, 2006, the Company accounted for employee stock-based

compensation using the intrinsic value method supplemented by pro forma disclosures in accordance with

Accounting Principles Board (“APB”) Opinion No. 25, “Accounting for Stock Issued to Employees” (“APB

25”) and SFAS No. 123, “Accounting for Stock-Based Compensation” (“SFAS 123”), as amended by SFAS No. 148,

“Accounting for Stock-Based Compensation — Transition and Disclosure — an amendment of FASB Statement

No. 123” (“SFAS 148”). Under the intrinsic value method, the recorded stock-based compensation expense was

related to the amortization of the intrinsic value of Yahoo! stock options and other stock-based awards issued by the

Company and assumed in connection with business combinations. Options granted with exercise prices equal to the

grant date fair value of the Company’s stock have no intrinsic value and therefore no expense was recorded for these

options under APB 25. For stock options whose exercise price was below the grant date fair value of the Company’s

stock (principally options assumed in business combinations), the difference between the exercise price and the

grant date fair value of the Company’s stock was expensed over the service period (generally the vesting period)

using an accelerated amortization approach in accordance with the FASB Interpretation No. 28, “Accounting for

Stock Appreciation Rights and Other Variable Stock Option or Award Plans.” Other stock-based awards for which

stock-based compensation expense was recorded were generally grants of restricted stock awards which were

measured at fair value on the date of grant, based on the number of shares granted, and the quoted price of the

Company’s common stock. Such value was recognized as an expense over the corresponding service period.

Effective January 1, 2006, the Company adopted SFAS 123R using the modified prospective approach and

accordingly, prior periods have not been restated to reflect the impact of SFAS 123R. Under SFAS 123R, stock-

based awards granted prior to its adoption are expensed over the remaining portion of their service period. These

awards are expensed under an accelerated amortization approach using the same fair value measurements which

were used in calculating pro forma stock-based compensation expense under SFAS 123. For stock-based awards

granted on or after January 1, 2006, the Company records stock-based compensation expense on a straight-line basis

over the requisite service period, generally one to four years. SFAS 123R required that the deferred stock-based

compensation on the consolidated balance sheet on the date of adoption be netted against additional paid-in capital.

As of December 31, 2005, there was a balance of $235 million of deferred stock-based compensation that was

netted against additional paid-in capital on January 1, 2006.

The Company has elected to use the “with and without” approach as described in EITF Topic No. D-32 in

determining the order in which tax attributes are utilized. As a result, the Company will only recognize a tax benefit

from stock-based awards in additional paid-in capital if an incremental tax benefit is realized after all other tax

attributes currently available to the Company have been utilized. In addition, the Company has elected to account

for the indirect effects of stock-based awards on other tax attributes, such as the research tax credit, through the

income statement.

68

Yahoo! Inc.

Notes to Consolidated Financial Statements — (Continued)