Verizon Wireless 2011 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2011 Verizon Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

nOtEs tO cOnsOlidatEd Financial statEMEnts continued

75

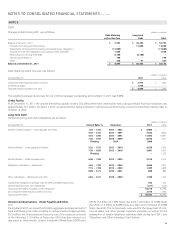

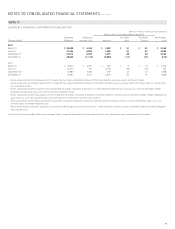

NOTE 12

TAXES

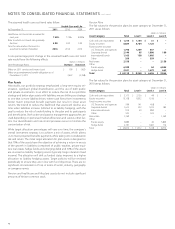

The components of income before provision for income taxes are

as follows:

(dollars in millions)

Years Ended December 31, 2011 2010 2009

Domestic $ 9,724 $ 11,921 $ 12,625

Foreign 759 763 895

Total $ 10,483 $ 12,684 $ 13,520

The components of the provision for income taxes are as follows:

(dollars in millions)

Years Ended December 31, 2011 2010 2009

Current

Federal $ 193 $ (705) $ (611)

Foreign 25 (19) 73

State and Local 290 (42) 364

Total 508 (766) (174)

Deferred

Federal 276 2,945 1,616

Foreign (38) (24) (35)

State and Local (455) 316 518

Total (217) 3,237 2,099

Investment tax credits (6) (4) (6)

Total income tax provision $ 285 $ 2,467 $ 1,919

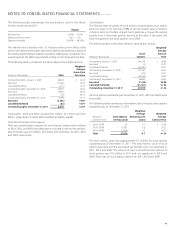

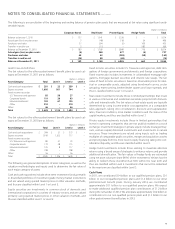

The following table shows the principal reasons for the difference

between the effective income tax rate and the statutory federal income

tax rate:

Years Ended December 31, 2011 2010 2009

Statutory federal income tax rate 35.0% 35.0% 35.0%

State and local income tax rate,

net of federal tax benefits (1.0) 1.4 1.5

Affordable housing credit (1.8) (1.3) (1.0)

Employee benefits including

ESOP dividend (1.4) (1.2) (1.6)

Medicare Part D subsidy charge –6.9 –

Equity in earnings from

unconsolidated businesses (1.9) (1.6) (1.6)

Noncontrolling interest (23.0) (19.5) (16.0)

Other, net (3.2) (0.3) (2.1)

Effective income tax rate 2.7% 19.4% 14.2%

The effective income tax rate in 2011 decreased to 2.7% from 19.4% in

2010. This decrease was primarily driven by lower income before provi-

sion for income taxes as a result of higher pension and benefit charges

recorded in 2011 as well as tax benefits from state valuation allowance

reversals in 2011. The decrease was also due to a one-time, non-cash

income tax charge of $1.0 billion recorded during the three months ended

March 31, 2010 as a result of the enactment of the Patient Protection and

Affordable Care Act and the Health Care and Education Reconciliation

Act of 2010, both of which became law in March 2010 (collectively the

Health Care Act). Under the Health Care Act, beginning in 2013, Verizon

and other companies that receive a subsidy under Medicare Part D to

provide retiree prescription drug coverage will no longer receive a fed-

eral income tax deduction for the expenses incurred in connection with

providing the subsidized coverage to the extent of the subsidy received.

Because future anticipated retiree prescription drug plan liabilities and

related subsidies are already reflected in Verizon’s financial statements,

this change in law required Verizon to reduce the value of the related tax

benefits recognized in its financial statements in the period during which

the Health Care Act was enacted.

The effective income tax rate in 2010 increased to 19.4% from 14.2% in

2009. The increase was primarily driven by a one-time, non-cash income

tax charge of $1.0 billion for the Health Care Act described above. The

increase was partially offset primarily by higher earnings attributable to

Vodafone’s noncontrolling interest in the Verizon Wireless partnership.

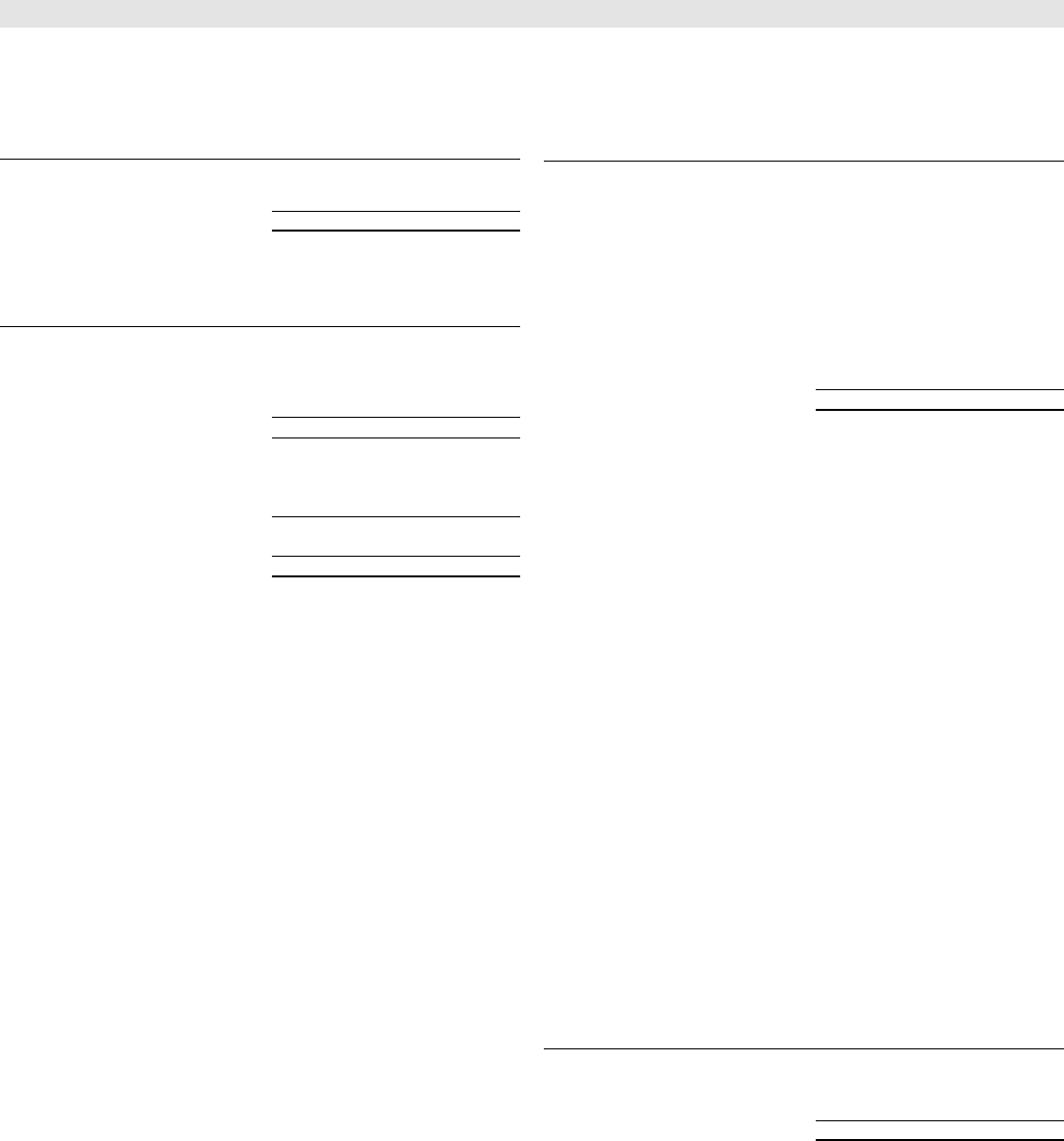

The amounts of cash taxes paid are as follows:

(dollars in millions)

Years Ended December 31, 2011 2010 2009

Income taxes, net of amounts refunded $ 762 $ 430 $ 158

Employment taxes 1,231 1,296 1,349

Property and other taxes 1,883 1,963 2,065

Total $ 3,876 $ 3,689 $ 3,572