Yahoo 2009 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2009 Yahoo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Yahoo! Inc.

Notes to Consolidated Financial Statements—(Continued)

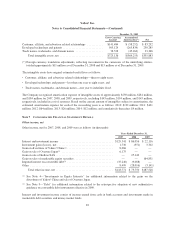

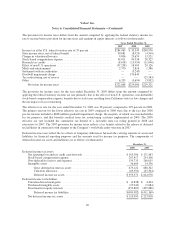

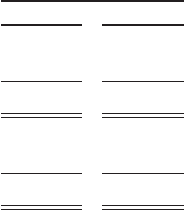

The total unrecognized tax benefits as of December 31, 2008 and 2009 include approximately $452 million and

$420 million, respectively, of unrecognized tax benefits that have been netted against the related deferred tax

assets. The remaining balances are recorded on the Company’s consolidated balance sheets as follows (in

thousands):

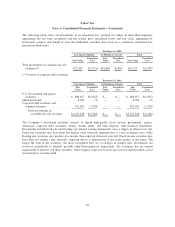

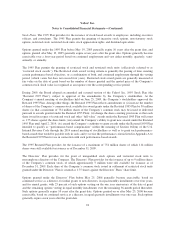

December 31,

2008 2009

Total unrecognized tax benefits balance ...................................... $798,057 $ 893,475

Amounts netted against related deferred tax assets .............................. (451,790) (419,782)

Unrecognized tax benefits recorded on consolidated balance sheets ................. $346,267 $ 473,693

Amounts classified as accrued expenses and other current liabilities ................ $ 5,519 $ 53,858

Amounts classified as deferred and other long-term tax liabilities, net ............... 340,748 419,835

Unrecognized tax benefits recorded on consolidated balance sheets ................. $346,267 $ 473,693

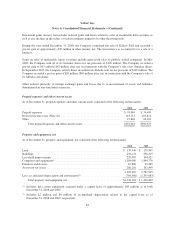

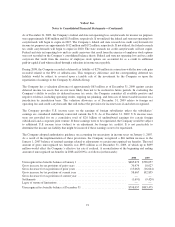

The Company recognizes interest and/or penalties related to uncertain tax positions in income tax expense. To

the extent accrued interest and penalties do not ultimately become payable, amounts accrued will be reduced and

reflected as a reduction of the overall income tax provision in the period that such determination is made. During

2008 and 2009, interest and penalties recorded in the consolidated statements of income were $6 million and $3

million, respectively. The amounts of accrued interest and penalties recorded on the consolidated balance sheets

as of December 31, 2008 and 2009 were approximately $12 million and $15 million, respectively.

The Company files income tax returns in the U.S. federal jurisdiction and in many U.S. states and foreign

jurisdictions. The tax years 1995 to 2008 remain open to examination by the major taxing jurisdictions in which

the Company is subject to tax. The examination of the Company’s federal income tax returns for the years ended

December 31, 2003 and December 31, 2004 was completed in 2008 and resulted in no material adjustments.

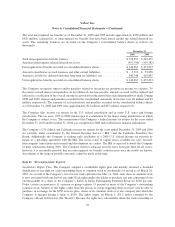

The Company’s U.S. federal and California income tax returns for the years ended December 31, 2005 and 2006

are currently under examination by the Internal Revenue Service (“IRS”) and the California Franchise Tax

Board. Additionally the Company is seeking early resolution of a 2009 U.S. federal income tax position by

means of a pre-filing agreement with the IRS. The issues relate to capital losses available for carry forward,

intercompany transactions and research and development tax credits. The IRS is expected to notify the Company

of their conclusions during 2010. The Company believes adequate reserves have been provided for all issues;

however, it is reasonably possible that our unrecognized tax benefits could increase once the results are known.

An estimate of the range of possible outcomes cannot be made at this time.

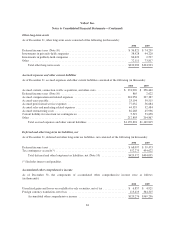

Note 11 S

TOCKHOLDERS

’E

QUITY

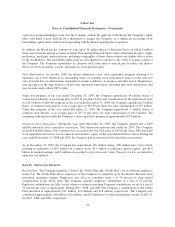

Stockholder Rights Plan. The Company adopted a stockholder rights plan and initially declared a dividend

distribution of one right for each outstanding share of common stock to stockholders of record as of March 20,

2001. As a result of the Company’s two-for-one stock split effective May 11, 2004, each share of common stock

is now associated with one-half of one right. Each right entitles the holder to purchase one unit consisting of one

one-thousandth of a share of the Company’s Series A Junior Participating Preferred Stock for $250 per unit.

Under certain circumstances, if a person or group acquires 15 percent or more of the Company’s outstanding

common stock, holders of the rights (other than the person or group triggering their exercise) will be able to

purchase, in exchange for the $250 exercise price, shares of its common stock or of any company into which the

Company is merged having a value of $500. The rights expire on March 1, 2011, unless extended by the

Company’s Board of Directors (the “Board”). Because the rights may substantially dilute the stock ownership of

92