Yahoo 2009 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2009 Yahoo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Yahoo! Inc.

Notes to Consolidated Financial Statements—(Continued)

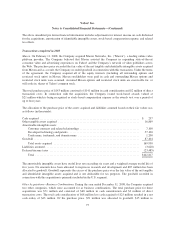

The above unaudited pro forma financial information includes adjustments for interest income on cash disbursed

for the acquisitions, amortization of identifiable intangible assets, stock-based compensation expense, and related

tax effects.

Transactions completed in 2008

Maven. On February 11, 2008, the Company acquired Maven Networks, Inc. (“Maven”), a leading online video

platform provider. The Company believed that Maven assisted the Company in expanding state-of-the-art

consumer video and advertising experiences on Yahoo! and the Company’s network of video publishers across

the Web. The purchase price exceeded the fair value of the net tangible and identifiable intangible assets acquired

from Maven and as a result, the Company recorded goodwill in connection with this transaction. Under the terms

of the agreement, the Company acquired all of the equity interests (including all outstanding options and

restricted stock units) in Maven. Maven stockholders were paid in cash and outstanding Maven options and

restricted stock units were assumed. Assumed Maven options and restricted stock units are exercisable for, or

will settle in, shares of Yahoo! common stock.

The total purchase price of $143 million consisted of $141 million in cash consideration and $2 million of direct

transaction costs. In connection with the acquisition, the Company issued stock-based awards valued at

$21 million which is being recognized as stock-based compensation expense as the awards vest over a period of

up to four years.

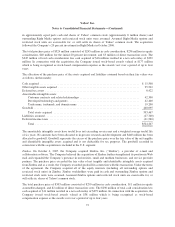

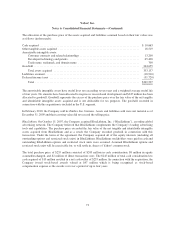

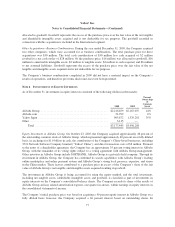

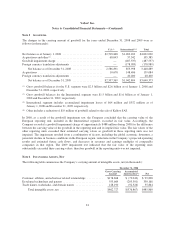

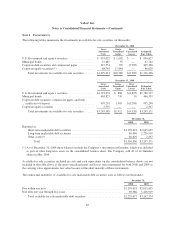

The allocation of the purchase price of the assets acquired and liabilities assumed based on their fair values was

as follows (in thousands):

Cash acquired ...................................................................... $ 257

Other tangible assets acquired ......................................................... 16,869

Amortizable intangible assets:

Customer contracts and related relationships .......................................... 7,100

Developed technology and patents .................................................. 57,100

Trade name, trademark, and domain name ........................................... 1,200

Goodwill .......................................................................... 87,404

Total assets acquired ............................................................ 169,930

Liabilities assumed .................................................................. (3,628)

Deferred income taxes ............................................................... (23,485)

Total ......................................................................... $142,817

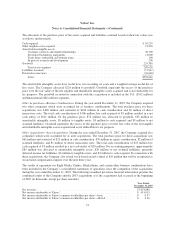

The amortizable intangible assets have useful lives not exceeding six years and a weighted average useful life of

five years. No amounts have been allocated to in-process research and development and $87 million has been

allocated to goodwill. Goodwill represents the excess of the purchase price over the fair value of the net tangible

and identifiable intangible assets acquired and is not deductible for tax purposes. The goodwill recorded in

connection with this acquisition is primarily included in the U.S. segment.

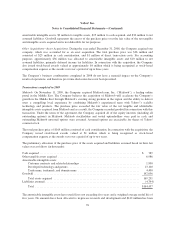

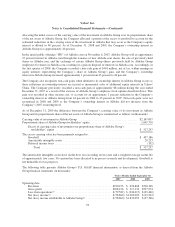

Other Acquisitions—Business Combinations. During the year ended December 31, 2008, the Company acquired

two other companies, which were accounted for as business combinations. The total purchase price for these

acquisitions was $71 million and consisted of $68 million in cash consideration and $3 million of direct

transaction costs. The total cash consideration of $68 million less cash acquired of $25 million resulted in a net

cash outlay of $43 million. Of the purchase price, $51 million was allocated to goodwill, $15 million to

75