Humana 2008 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2008 Humana annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

reported in the consolidated financial statements and accompanying notes. We continuously evaluate our

estimates and those critical accounting policies related primarily to benefit expenses and revenue recognition as

well as accounting for impairments related to our investment securities, goodwill, and long-lived assets. These

estimates are based on knowledge of current events and anticipated future events and, accordingly, actual results

ultimately may differ from those estimates. We believe the following critical accounting policies involve the

most significant judgments and estimates used in the preparation of our consolidated financial statements.

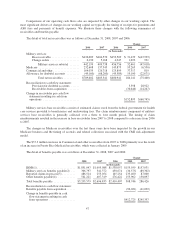

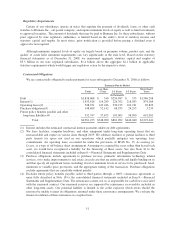

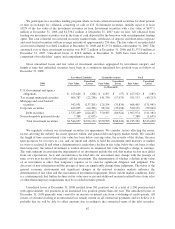

Benefit Expense Recognition

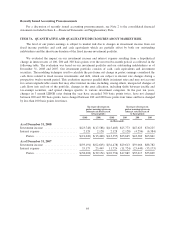

Benefit expenses are recognized in the period in which services are provided and include an estimate of the

cost of services which have been incurred but not yet reported, or IBNR. IBNR represents a substantial portion of

our benefits payable as follows:

December 31,

2008

Percentage

of Total

December 31,

2007

Percentage

of Total

(dollars in thousands)

IBNR .......................................... $1,851,047 57.7% $1,695,088 62.8%

Reported claims in process ......................... 486,514 15.2% 253,054 9.4%

Other benefits payable ............................. 561,221 17.5% 407,319 15.1%

Benefits payable, excluding military services ....... 2,898,782 90.4% 2,355,461 87.3%

Military services benefits payable .................... 306,797 9.6% 341,372 12.7%

Total benefits payable ......................... $3,205,579 100.0% $2,696,833 100.0%

Military services benefits payable primarily consists of our estimate of incurred healthcare services provided

to beneficiaries which are in turn reimbursed by the federal government as more fully described in Note 2 to the

consolidated financial statements included in Item 8.—Financial Statements and Supplementary Data. This

amount is generally offset by a corresponding receivable due from the federal government, as more fully-

described on page 47.

Estimating IBNR is complex and involves a significant amount of judgment. Changes in this estimate can

materially affect, either favorably or unfavorably, our results of operations and overall financial position.

Accordingly, it represents a critical accounting estimate. Most benefit claims are paid within a few months of the

member receiving service from a physician or other health care provider. As a result, these liabilities generally

are described as having a “short-tail”. As such, we expect that substantially all of the December 31, 2008

estimate of benefits payable will be known and paid during 2009.

Our reserving practice is to consistently recognize the actuarial best point estimate within a level of

confidence required by actuarial standards. Actuarial standards of practice generally require a level of confidence

such that the liabilities established for IBNR have a greater probability of being adequate versus being

insufficient, or such that the liabilities established for IBNR are sufficient to cover obligations under an

assumption of moderately adverse conditions. Adverse conditions are situations in which the actual claims are

expected to be higher than the otherwise estimated value of such claims at the time of the estimate. Therefore, in

many situations, the claim amounts ultimately settled will be less than the estimate that satisfies the actuarial

standards of practice.

We develop our estimate for IBNR using actuarial methodologies and assumptions, primarily based upon

historical claim experience. Depending on the period for which incurred claims are estimated, we apply a

different method in determining our estimate. For periods prior to the most recent three months, the key

assumption used in estimating our IBNR is that the completion factor pattern remains consistent over a rolling

12-month period after adjusting for known changes in claim inventory levels and known changes in claim

payment processes. Completion factors result from the calculation of the percentage of claims incurred during a

54