Target 2011 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2011 Target annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.and/or length of service. These company-paid benefits include a pension plan, 401(k) plan, medical and dental

plans, a retiree medical plan, disability insurance, paid vacation, tuition reimbursement, various team member

assistance programs, life insurance and merchandise discounts.

Working Capital

Because of the seasonal nature of our business, our working capital needs are greater in the months leading

up to our peak sales period from Thanksgiving to the end of December. The increase in working capital during this

time is typically financed with cash flow provided by operations and short-term borrowings.

Additional details are provided in the Liquidity and Capital Resources section in Item 7, Management’s

Discussion and Analysis of Financial Condition and Results of Operations.

Competition

In our U.S. Retail Segment, we compete with traditional and off-price general merchandise retailers, apparel

retailers, internet retailers, wholesale clubs, category specific retailers, drug stores, supermarkets and other forms

of retail commerce in the U.S. Our ability to positively differentiate ourselves from other retailers largely determines

our competitive position within the U.S. retail industry. In our Canadian Segment, we will compete with similar retail

categories and will be focused on positively differentiating ourselves within the Canadian retail market.

In our U.S. Credit Card Segment, our primary mission is to deliver financial products and services that drive

sales and deepen guest relationships at Target. Our financial products compete with those of other issuers for

market share of sales volume. Our ability to positively differentiate the value of our financial products primarily

through our rewards programs, terms, credit line management, and guest service determines our competitive

position among credit card issuers.

Intellectual Property

Our brand image is a critical element of our business strategy. Our principal trademarks, including Target,

SuperTarget and our ‘‘Bullseye Design,’’ have been registered with the U.S. Patent and Trademark Office. We also

seek to obtain and preserve intellectual property protection for our private-label brands.

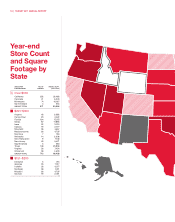

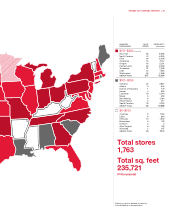

Geographic Information

All of our revenues are generated within the United States and a vast majority of our long-lived assets are

located within the U.S. as well. As we expand our operations internationally, a modest percentage of our revenues

and long-lived assets will be located in Canada.

Available Information

Our Annual Report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and

amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act are available

free of charge at www.Target.com (click on ‘‘Investor Relations’’ and ‘‘SEC Filings’’) as soon as reasonably

practicable after we file such material with, or furnish it to, the Securities and Exchange Commission (SEC). Our

Corporate Governance Guidelines, Business Conduct Guide, Corporate Responsibility Report and the position

descriptions for our Board of Directors and Board committees are also available free of charge in print upon request

or at www.Target.com/Investors.

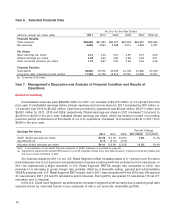

Item 1A. Risk Factors

Our business is subject to a variety of risks. The most important of these is our ability to remain relevant to our

guests with a brand they trust. Meeting our guests’ expectations requires us to manage various strategic,

operational, compliance, reputational, and financial risks. Set forth below are the most significant risks that we face.

4