American Express 2014 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2014 American Express annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.AMERICAN EXPRESS COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

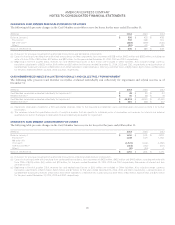

TOTAL REVENUES NET OF INTEREST EXPENSE

Discount Revenue

Discount revenue represents the amount earned by the Company on transactions occurring at merchants with which the Company, or a

Global Network Services (GNS) partner, has entered into card acceptance agreements for facilitating transactions between the merchants and

the Company’s Card Members. The discount fee generally is deducted from the payment to the merchant and recorded as discount revenue

at the time the charge is captured.

Net Card Fees

Card fees, net of direct card acquisition costs and a reserve for projected membership cancellations, are deferred and recognized on a

straight-line basis over the 12-month card membership period as Net Card Fees in the Consolidated Statements of Income. The unamortized

net card fee balance is reported net in Other Liabilities on the Consolidated Balance Sheets (refer to Note 10).

Travel Commissions and Fees

The Company earns travel commissions and fees by charging clients transaction or management fees for selling and arranging travel and for

travel management services. Client transaction fee revenue is recognized at the time the client books the travel arrangements. Travel

management services revenue is recognized over the contractual term of the agreement. The Company’s travel suppliers (e.g., airlines, hotels

and car rental companies) pay commissions and fees on tickets issued, sales and other services based on contractual agreements.

Commissions and fees from travel suppliers are generally recognized at the time a ticket is purchased or over the term of the contract.

Commissions and fees that are based on services rendered (e.g., hotel stays and car rentals) are recognized based on usage.

Other Commissions and Fees

Other commissions and fees include foreign currency conversion fees, Card Member delinquency fees, service fees and other card-related

assessments, which are recognized primarily in the period in which they are charged to the Card Member (refer to Note 19). In addition,

service fees are also earned from other customers (e.g., merchants) for a variety of services and are recognized when the service is performed,

which is generally in the period the fee is charged. Also included are fees related to the Company’s Membership Rewards program, which are

deferred and recognized over the period covered by the fee. The unamortized Membership Rewards fee balance is included in Other

Liabilities on the Consolidated Balance Sheets (refer to Note 10).

Contra-revenue

The Company regularly makes payments through contractual arrangements with merchants, corporate payments clients, Card Members and

certain other customers. Payments to such customers, including cash rebates paid to Card Members, are generally classified as contra-

revenue unless a specifically identifiable benefit (e.g., goods or services) is received by the Company or its Card Members in consideration for

that payment, and the fair value of such benefit is determinable and measurable. If no such benefit is identified, then the entire payment is

classified as contra-revenue and included in the Consolidated Statements of Income in the revenue line item where the related transactions

are recorded (e.g., discount revenue, travel commissions and fees and other commissions and fees). If such a benefit is identified, then the

payment is classified as expense up to the estimated fair value of the benefit.

Interest Income

Interest on Card Member loans is assessed using the average daily balance method. Unless the loan is classified as non-accrual, interest is

recognized based upon the outstanding balance, in accordance with the terms of the applicable account agreement, until the outstanding

balance is paid or written off.

Interest and dividends on investment securities primarily relates to the Company’s performing fixed-income securities. Interest income is

accrued as earned using the effective interest method, which adjusts the yield for security premiums and discounts, fees and other payments,

so that a constant rate of return is recognized on the investment security’s outstanding balance. Amounts are recognized until such time as a

security is in default or when it is likely that future interest payments will not be received as scheduled.

Interest on deposits with banks and other is recognized as earned, and primarily relates to the placement of cash in interest-bearing time

deposits, overnight sweep accounts, and other interest-bearing demand and call accounts.

76