Humana 2012 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2012 Humana annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Humana Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

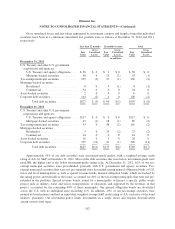

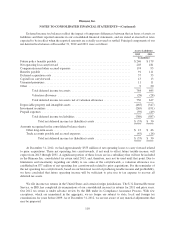

The recoverability of our non-agency residential and commercial mortgage-backed securities is supported

by factors such as seniority, underlying collateral characteristics and credit enhancements. These residential and

commercial mortgage-backed securities at December 31, 2012 primarily were composed of senior tranches

having high credit support, with over 99% of the collateral consisting of prime loans. The weighted average

credit rating of all commercial mortgage-backed securities was AA+ at December 31, 2012.

The percentage of corporate securities associated with the financial services industry was 22.8% at

December 31, 2012 and 19.3% at December 31, 2011.

Several European countries, including Spain, Italy, Ireland, Portugal, and Greece, have been subject to

credit deterioration due to weakness in their economic and fiscal situations. We have no direct exposure to

sovereign issuances of these five countries.

All issuers of securities we own that were trading at an unrealized loss at December 31, 2012 remain current

on all contractual payments. After taking into account these and other factors previously described, we believe

these unrealized losses primarily were caused by an increase in market interest rates and tighter liquidity

conditions in the current markets than when the securities were purchased. At December 31, 2012, we did not

intend to sell the securities with an unrealized loss position in accumulated other comprehensive income, and it is

not likely that we will be required to sell these securities before recovery of their amortized cost basis. As a

result, we believe that the securities with an unrealized loss were not other-than-temporarily impaired at

December 31, 2012.

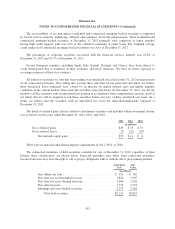

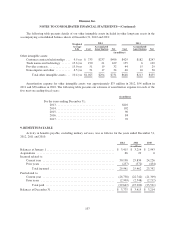

The detail of realized gains (losses) related to investment securities and included within investment income

was as follows for the years ended December 31, 2012, 2011, and 2010:

2012 2011 2010

(in millions)

Gross realized gains ....................................... $38 $33 $35

Gross realized losses ...................................... (5) (22) (29)

Net realized capital gains ............................... $33 $11 $ 6

There were no material other-than-temporary impairments in 2012, 2011, or 2010.

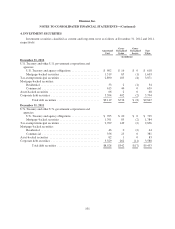

The contractual maturities of debt securities available for sale at December 31, 2012, regardless of their

balance sheet classification, are shown below. Expected maturities may differ from contractual maturities

because borrowers may have the right to call or prepay obligations with or without call or prepayment penalties.

Amortized

Cost

Fair

Value

(in millions)

Due within one year ................................ $ 359 $ 362

Due after one year through five years .................. 1,826 1,907

Due after five years through ten years .................. 2,946 3,220

Due after ten years ................................. 1,755 1,994

Mortgage and asset-backed securities .................. 2,233 2,364

Total debt securities ............................ $9,119 $9,847

103