Humana 2012 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2012 Humana annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Humana Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

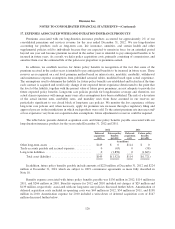

17. EXPENSES ASSOCIATED WITH LONG-DURATION INSURANCE PRODUCTS

Premiums associated with our long-duration insurance products accounted for approximately 2% of our

consolidated premiums and services revenue for the year ended December 31, 2012. We use long-duration

accounting for products such as long-term care, life insurance, annuities, and certain health and other

supplemental policies sold to individuals because they are expected to remain in force for an extended period

beyond one year and because premium received in the earlier years is intended to pay anticipated benefits to be

incurred in future years.As a result, we defer policy acquisition costs, primarily consisting of commissions, and

amortize them over the estimated life of the policies in proportion to premiums earned.

In addition, we establish reserves for future policy benefits in recognition of the fact that some of the

premium received in the earlier years is intended to pay anticipated benefits to be incurred in future years. These

reserves are recognized on a net level premium method based on interest rates, mortality, morbidity, withdrawal

and maintenance expense assumptions from published actuarial tables, modified based upon actual experience.

The assumptions used to determine the liability for future policy benefits are established and locked in at the time

each contract is acquired and would only change if our expected future experience deteriorated to the point that

the level of the liability, together with the present value of future gross premiums, are not adequate to provide for

future expected policy benefits. Long-term care policies provide for long-duration coverage and, therefore, our

actual claims experience will emerge many years after assumptions have been established. The risk of a deviation

of the actual interest rates, morbidity rates, and mortality rates from those assumed in our reserves are

particularly significant to our closed block of long-term care policies. We monitor the loss experience of these

long-term care policies and, when necessary, apply for premium rate increases through a regulatory filing and

approval process in the jurisdictions in which such products were sold. To the extent premium rate increases and/

or loss experience vary from our acquisition date assumptions, future adjustments to reserves could be required.

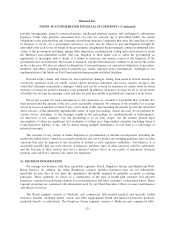

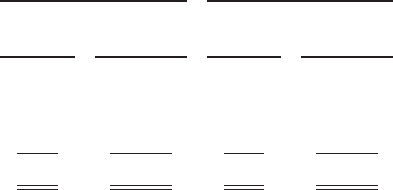

The table below presents deferred acquisition costs and future policy benefits payable associated with our

long-duration insurance products for the years ended December 31, 2012 and 2011.

2012 2011

Deferred

acquisition

costs

Future policy

benefits

payable

Deferred

acquisition

costs

Future policy

benefits

payable

(in millions)

Other long-term assets ............................. $149 $ 0 $114 $ 0

Trade accounts payable and accrued expenses ........... 0 (63) 0 (58)

Long-term liabilities ............................... 0 (1,858) 0 (1,663)

Total asset (liability) ........................... $149 $(1,921) $114 $(1,721)

In addition, future policy benefits payable include amounts of $220 million at December 31, 2012 and $224

million at December 31, 2011 which are subject to 100% coinsurance agreements as more fully described in

Note 18.

Benefits expense associated with future policy benefits payable was $136 million in 2012, $114 million in

2011, and $266 million in 2010. Benefits expense for 2012 and 2010 included net charges of $29 million and

$139 million, respectively, associated with our long-term care policies discussed further below. Amortization of

deferred acquisition costs included in operating costs was $44 million in 2012, $34 million in 2011, and $198

million in 2010. Amortization expense for 2010 included a write-down of deferred acquisition costs of $147

million discussed further below.

126