Humana 2006 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2006 Humana annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Humana Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

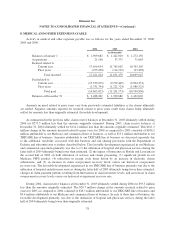

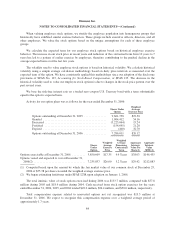

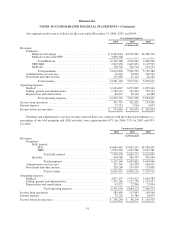

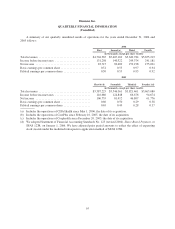

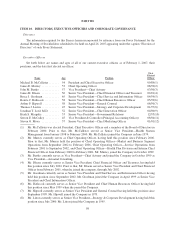

Future annual minimum payments due subsequent to December 31, 2006 under all of our noncancelable

operating leases with initial terms in excess of one year are as follows:

Minimum

Lease

Payments

Sublease

Rental

Receipts

Net Lease

Commitments

(in thousands)

For the years ending December 31:

2007 .................................. $ 88,196 $(1,988) $ 86,208

2008 .................................. 66,974 (774) 66,200

2009 .................................. 50,217 (173) 50,044

2010 .................................. 41,103 — 41,103

2011 .................................. 23,021 — 23,021

Thereafter .............................. 15,368 — 15,368

Total .............................. $284,879 $(2,935) $281,944

Purchase Obligations

We have agreements to purchase services, primarily information technology related services, or to make

improvements to real estate, in each case that are enforceable and legally binding on us and that specify all

significant terms, including: fixed or minimum levels of service to be purchased; fixed, minimum or variable

price provisions; and the appropriate timing of the transaction. We have purchase obligation commitments of

$27.4 million in 2007, $14.5 million in 2008, $3.7 million in 2009, $2.8 million in 2010 and $1.3 million

thereafter. Purchase obligations exclude agreements that are cancelable without penalty.

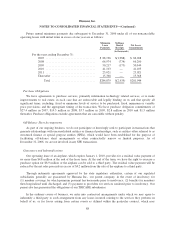

Off-Balance Sheet Arrangements

As part of our ongoing business, we do not participate or knowingly seek to participate in transactions that

generate relationships with unconsolidated entities or financial partnerships, such as entities often referred to as

structured finance or special purpose entities (SPEs), which would have been established for the purpose of

facilitating off-balance sheet arrangements or other contractually narrow or limited purposes. As of

December 31, 2006, we are not involved in any SPE transactions.

Guarantees and Indemnifications

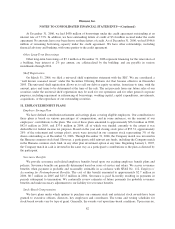

Our operating lease of an airplane, which expires January 1, 2010, provides for a residual value payment of

no more than $4.8 million at the end of the lease term. At the end of the term, we have the right to exercise a

purchase option for $8.9 million or the airplane can be sold to a third party. The residual value payment will be

reduced by the net sales proceeds in excess of $4.2 million from the sale of the airplane to a third party.

Through indemnity agreements approved by the state regulatory authorities, certain of our regulated

subsidiaries generally are guaranteed by Humana Inc., our parent company, in the event of insolvency for

(1) member coverage for which premium payment has been made prior to insolvency; (2) benefits for members

then hospitalized until discharged; and (3) payment to providers for services rendered prior to insolvency. Our

parent also has guaranteed the obligations of our TRICARE subsidiaries.

In the ordinary course of business, we enter into contractual arrangements under which we may agree to

indemnify a third party to such arrangement from any losses incurred relating to the services they perform on

behalf of us, or for losses arising from certain events as defined within the particular contract, which may

88