Humana 2006 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2006 Humana annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Humana Inc.

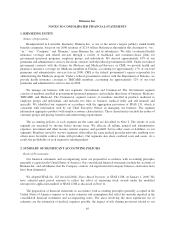

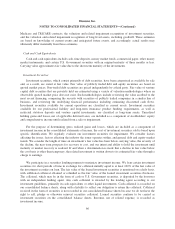

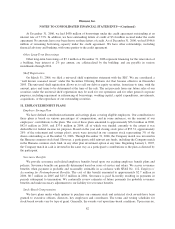

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

average number of unrestricted common shares outstanding plus the dilutive effect of outstanding employee

stock options and restricted shares using the treasury stock method.

Recently Issued Accounting Pronouncements

In July 2006, the FASB issued FASB Interpretation No. 48, Accounting for Uncertainty in Income Taxes-an

Interpretation of FASB Statement 109, or FIN 48. FIN 48 prescribes a comprehensive model for how a company

should recognize, measure, present, and disclose in its financial statements uncertain tax positions that the

company has taken or expects to take on a tax return. FIN 48 also revises disclosure requirements and introduces

a prescriptive, annual, tabular roll-forward of the unrecognized tax benefits. FIN 48, which became effective for

us beginning January 1, 2007, requires the change in net assets that results from the application of the new

accounting model to be reflected as an adjustment to retained earnings. The adoption of FIN 48 did not have a

material impact on our financial position or results of operations.

In September 2006, the FASB issued Statement of Financial Accounting Standards No. 158, Employers’

Accounting for Defined Benefit Pension and Other Postretirement Plans, or SFAS 158. We adopted SFAS 158

prospectively in the fourth quarter of 2006 for the year ending December 31, 2006. SFAS 158 requires an

employer to recognize the overfunded or underfunded status of a defined benefit postretirement plan (other than a

multiemployer plan) as an asset or liability in its statement of financial position, and to recognize changes in that

funded status in the year in which the changes occur through comprehensive income. SFAS 158 also requires an

employer to measure the funded status of a plan as of the date of its year-end statement of financial position and

revises certain disclosure requirements. The benefit obligation is defined as the projected benefit obligation for

pension plans and as the accumulated postretirement benefit obligation for any other postretirement benefit plan,

such as a retiree health care plan. The adoption of SFAS 158 did not have a material impact on our financial

position.

In September 2006, the FASB issued SFAS No. 157, Fair Value Measurements, or SFAS 157. SFAS 157

defines fair value, establishes a framework for measuring fair value, and expands disclosures about fair value

measurements. SFAS 157 does not require new fair value measurements. We are required to adopt SFAS 157 in

the first quarter of 2008. We currently are evaluating the provisions of SFAS 157, however, we do not expect the

adoption of SFAS 157 will have a material impact on our financial position or results of operations.

3. ACQUISITIONS

On May 1, 2006, our Commercial segment acquired CHA Service Company, or CHA Health, a health plan

serving employer groups in Kentucky, for cash consideration of $67.5 million, including a $1.7 million

contingent purchase price settlement paid in January 2007. This acquisition strengthens our position in the

Kentucky market. The fair value of net tangible assets acquired of $20.0 million primarily consisted of cash and

cash equivalents. The purchase price exceeded the estimated fair value of the net tangible assets acquired by

approximately $47.5 million. We allocated this excess purchase price to other intangible assets of $12.2 million

and associated deferred tax liabilities of $4.6 million, and non-deductible goodwill of $39.9 million. The other

intangible assets, which primarily consist of customer contracts, have a weighted average useful life of 6.8 years.

We used an independent third party valuation specialist firm to assist us in evaluating the fair value of assets

acquired.

On December 20, 2005, our Commercial segment acquired Corphealth, Inc., or Corphealth, a behavioral

health care management company, for cash consideration of $54.0 million.

On February 16, 2005, our Government segment acquired CarePlus Health Plans of Florida, or CarePlus, as

well as its affiliated 10 medical centers and pharmacy company, for cash consideration of $444.9 million.

72