Humana 2009 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2009 Humana annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Humana Inc.

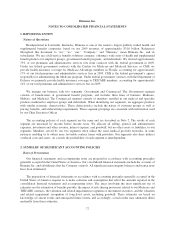

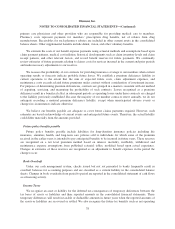

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

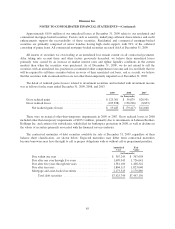

and capital loss carryforwards as deferred tax assets. A valuation allowance is provided against these deferred tax

assets if it is more likely than not that some portion or all of the deferred tax assets will not be realized. Future

years’ tax expense may be increased or decreased by adjustments to the valuation allowance or to the estimated

accrual for income taxes.

We record tax benefits when it is more likely than not that the tax return position taken with respect to a

particular transaction will be sustained. A liability, if recorded, is not considered resolved until the statute of

limitations for the relevant taxing authority to examine and challenge the tax position has expired, or the tax

position is ultimately settled through examination, negotiation, or litigation. We classify interest and penalties

associated with uncertain tax positions in our provision for income taxes.

Derivative Financial Instruments

At times, we may use interest-rate swap agreements to manage our exposure to interest rate risk. The

differential between fixed and variable rates to be paid or received is accrued and recognized over the life of the

agreements as adjustments to interest expense in the consolidated statements of income. Our interest-rate swap

agreements convert the fixed interest rates on our senior notes to a variable rate and are accounted for as fair

value hedges. Our interest-rate swap agreements, terminated in 2008, are more fully described in Note 12.

Stock-Based Compensation

We recognize stock-based compensation expense, as determined on the date of grant at fair value, straight-

line over the period during which an employee is required to provide service in exchange for the award (usually

the vesting period). We estimate expected forfeitures and recognize compensation expense only for those awards

which are expected to vest. We estimate the grant-date fair value of stock options using the Black-Scholes

option-pricing model. In addition, we report certain tax effects of stock-based compensation as a financing

activity rather than an operating activity in the consolidated statement of cash flows. Additional detail regarding

our stock-based compensation plans is included in Note 13.

Earnings Per Common Share

We compute basic earnings per common share on the basis of the weighted-average number of unrestricted

common shares outstanding. Diluted earnings per common share is computed on the basis of the weighted-

average number of unrestricted common shares outstanding plus the dilutive effect of outstanding employee

stock options and restricted shares using the treasury stock method.

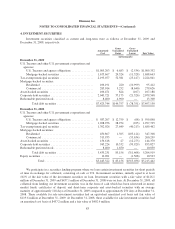

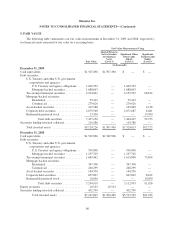

Fair Value

Assets and liabilities measured at fair value are categorized into a fair value hierarchy based on whether the

inputs to valuation techniques are observable or unobservable. Observable inputs reflect market data obtained

from independent sources, while unobservable inputs reflect our own assumptions about the assumptions market

participants would use. The fair value hierarchy includes three levels of inputs that may be used to measure fair

value as described below.

Level 1—Quoted prices in active markets for identical assets or liabilities. Level 1 assets and liabilities

include debt and equity securities that are traded in an active exchange market.

Level 2—Observable inputs other than Level 1 prices such as quoted prices in active markets for similar

assets or liabilities, quoted prices for identical or similar assets or liabilities in markets that are not active, or

other inputs that are observable or can be corroborated by observable market data for substantially the full

79