General Motors 2014 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2014 General Motors annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

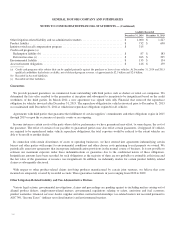

GENERAL MOTORS COMPANY AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

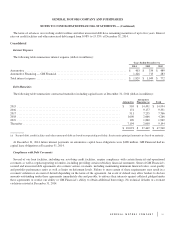

(a) Includes U.S. and sovereign government and agency issues.

(b) Includes mortgage and asset-backed securities.

(c) U.S. and non-U.S. Level 3 assets consist primarily of funds of hedge funds. Non-U.S. Level 2 assets consist primarily of equity and fixed

income funds.

(d) Includes private equity investment funds.

(e) Includes investment funds and public real estate investment trusts.

(f) Cash held by the plans, net of amounts receivable/payable for unsettled security transactions and payables for investment manager fees, custody

fees and other expenses.

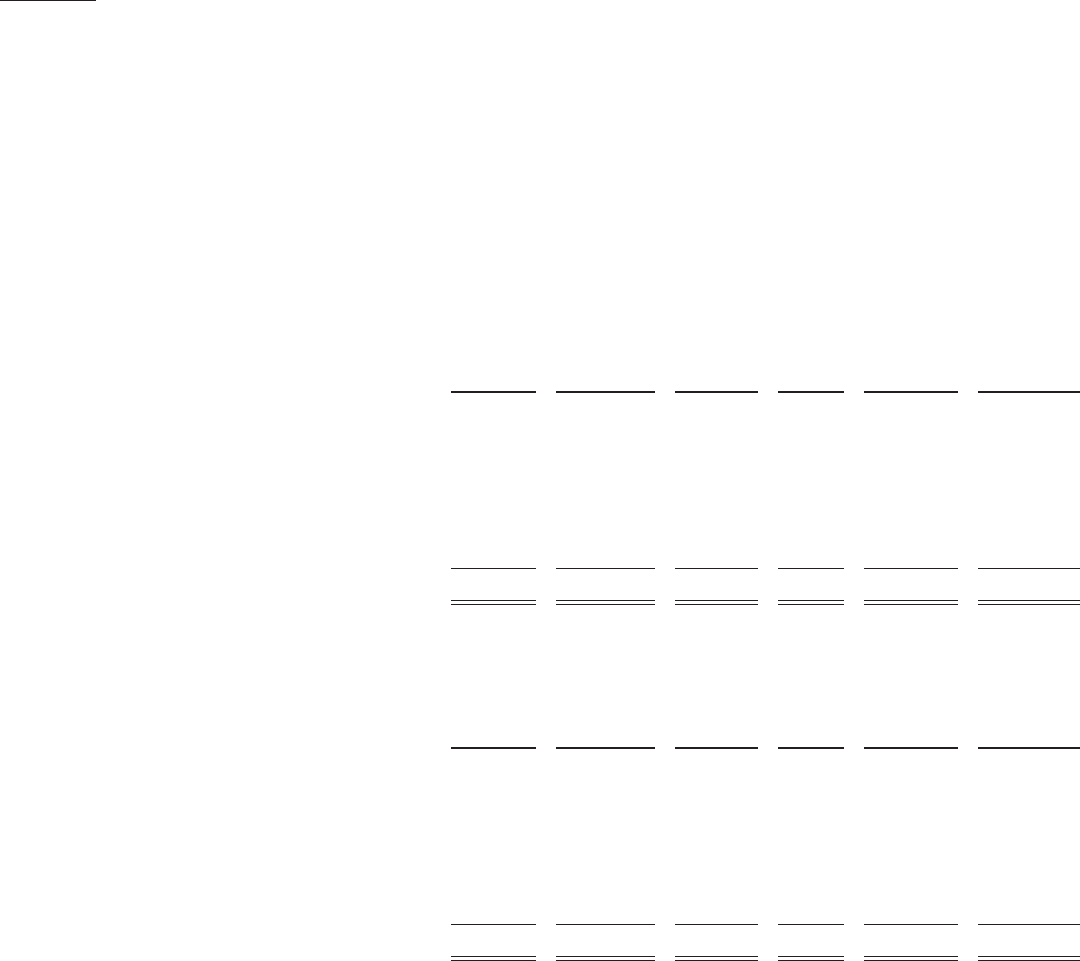

The following tables summarize the activity for U.S. defined benefit pension plan net assets measured at fair value using Level 3

inputs (dollars in millions):

Balance at

January 1,

2014

Net Realized/

Unrealized

Gains (Losses)

Purchases,

Sales and

Settlements,

Net

Transfers

Into/

Out

of Level 3

Balance at

December 31,

2014

Change in

Unrealized

Gains/(Losses)

Attributable to

Assets Held at

December 31,

2014

Common and preferred stocks .................. $ 6 $ 2 $ (5) $ — $ 3 $ —

Corporate and other debt securities ............... 130 — (41) (6) 83 (4)

Investment funds ............................. 5,174 231 (184) — 5,221 208

Private equity and debt investments .............. 6,335 651 (1,077) — 5,909 27

Real estate investments ........................ 4,127 251 (770) — 3,608 68

Other investments ............................ 62 5 (2) — 65 5

Derivatives, net .............................. (6) (4) 11 — 1 —

Total net assets .............................. $ 15,828 $ 1,136 $ (2,068) $ (6) $ 14,890 $ 304

Balance at

January 1,

2013

Net Realized/

Unrealized

Gains (Losses)

Purchases,

Sales and

Settlements,

Net

Transfers

Into/

Out of

Level 3

Balance at

December 31,

2013

Change in

Unrealized

Gains/(Losses)

Attributable to

Assets Held at

December 31,

2013

Common and preferred stocks .................. $ 19 $ 3 $ (16) $ — $ 6 $ 1

Corporate and other debt securities ............... 182 6 (58) — 130 (3)

Investment funds ............................. 4,959 552 (337) — 5,174 537

Private equity and debt investments .............. 6,400 926 (991) — 6,335 436

Real estate investments ........................ 4,335 458 (666) — 4,127 190

Other investments ............................ 63 (2) 1 — 62 (2)

Derivatives, net .............................. (8) 2 — — (6) 1

Total net assets .............................. $ 15,950 $ 1,945 $ (2,067) $ — $ 15,828 $ 1,160

106