General Motors 2014 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2014 General Motors annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

GENERAL MOTORS COMPANY AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

general and administrative expense or Automotive cost of sales. Amortization of developed technology and intellectual property is

recorded in Automotive cost of sales. Amortization of brand names, customer relationships and our dealer networks is recorded in

Automotive selling, general and administrative expense or GM Financial operating and other expenses.

Valuation of Long-Lived Assets

The carrying amount of long-lived assets and finite-lived intangible assets to be held and used in the business are evaluated for

impairment when events and circumstances warrant. If the carrying amount of a long-lived asset group is considered impaired, a loss

is recorded based on the amount by which the carrying amount exceeds fair value. Product-specific long-lived asset groups are tested

for impairment at the platform or vehicle line level and consider their geographical location. Non-product specific long-lived assets

are tested for impairment on a reporting unit basis in GMNA and GME and tested at or within our various reporting units within our

GMIO, GMSA and GM Financial segments. Fair value is determined using either the market or sales comparison approach, cost

approach or anticipated cash flows discounted at a rate commensurate with the risk involved. Long-lived assets to be disposed of other

than by sale are considered held for use until disposition. Product-specific assets may become impaired as a result of declines in

profitability due to changes in volume, pricing or costs.

Pension and OPEB Plans

Attribution, Methods and Assumptions

The cost of benefits provided by defined benefit pension plans is recorded in the period employees provide service. The cost of

pension plan amendments that provide for benefits already earned by plan participants is amortized over the expected period of

benefit which may be: (1) the duration of the applicable collective bargaining agreement specific to the plan; (2) expected future

working lifetime; or (3) the life expectancy of the plan participants.

The cost of medical, dental, legal service and life insurance benefits provided through postretirement benefit plans is recorded in

the period employees provide service. The cost of postretirement plan amendments that provide for benefits already earned by plan

participants is amortized over the expected period of benefit which may be: (1) the average period to full eligibility; (2) the average

life expectancy of the plan participants; or (3) the period to the plan’s termination date for a plan which provides legal services.

An expected return on plan asset methodology is utilized to calculate future pension expense for certain significant funded benefit

plans. A market-related value of plan assets methodology is also utilized that averages gains and losses on the plan assets over a

period of years to determine future pension expense. The methodology recognizes 60% of the difference between the fair value of

assets and the expected calculated value in the first year and 10% of that difference over each of the next four years.

The discount rate assumption is established for each of the retirement-related benefit plans at their respective measurement dates. In

the U.S. we use a cash flow matching approach that uses projected cash flows matched to spot rates along a high quality corporate

yield curve to determine the present value of cash flows to calculate a single equivalent discount rate.

The benefit obligation for pension plans in Canada, the United Kingdom and Germany represents 92% of the non-U.S. pension

benefit obligation at December 31, 2014. The discount rates for plans in Canada, the United Kingdom and Germany are determined

using a cash flow matching approach similar to the U.S. approach.

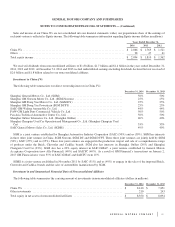

Plan Asset Valuation

Due to the lack of timely available market information for certain investments in the asset classes described below as well as the

inherent uncertainty of valuation, reported fair values may differ from fair values that would have been used had timely available

market information been available.

77