Humana 2004 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2004 Humana annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124

|

|

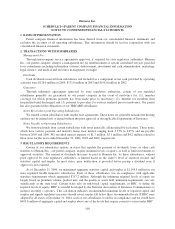

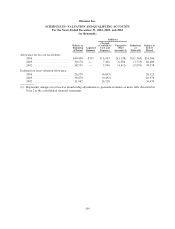

Humana Inc.

SCHEDULE II—VALUATION AND QUALIFYING ACCOUNTS

For the Years Ended December 31, 2004, 2003, and 2002

(in thousands)

Additions

Balance at

Beginning

of Period

Acquired

Balances

Charged

(Credited) to

Costs and

Expenses

Charged to

Other

Accounts (1)

Deductions

or

Write-offs

Balance at

End of

Period

Allowance for loss on receivables:

2004 ......................... $40,400 $355 $ 6,433 $(1,338) $(11,344) $34,506

2003 ......................... 30,178 — 7,416 6,584 (3,778) 40,400

2002 ......................... 38,539 — 5,990 (4,412) (9,939) 30,178

Deferred tax asset valuation allowance:

2004 ......................... 26,978 (6,855) 20,123

2003 ......................... 36,470 (9,492) 26,978

2002 ......................... 11,942 24,528 36,470

(1) Represents changes in retroactive membership adjustments to premium revenues as more fully described in

Note 2 to the consolidated financial statements.

109