Sony 2006 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2006 Sony annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

63

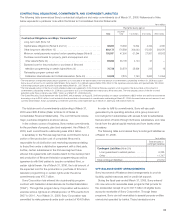

The following table contains available for sale and held to maturity securities, breaking out the unrealized gains and losses by

investment category:

Yen in millions

Unrealized Unrealized Fair market

March 31, 2006 Cost gain loss value

Financial Services Business:

Available for sale

Debt securities

Sony Life . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2,062,410 10,702 (15,122) 2,057,990

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

453,926 6,285 (7,561) 452,650

Equity securities

Sony Life . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

155,878 112,230 (1,137) 266,971

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9,323 4,176 (33) 13,466

Held to maturity

Debt securities

Sony Life . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

————

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

33,189 132 (221) 33,100

Total Financial Services . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2,714,726 133,525 (24,074) 2,824,177

Non-Financial Services:

Available for sale securities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

68,406 55,549 (546) 123,409

Held to maturity securities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4—— 4

Total Non-Financial Services . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

68,410 55,549 (546) 123,413

Consolidated . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2,783,136 189,074 (24,620) 2,947,590

In evaluating the factors for available-for-sale securities with

readily determinable fair values, management presumes a

decline in value to be other-than-temporary if the fair value of the

security is 20% or more below its original cost for an extended

period of time (generally a period of up to six to twelve months).

The presumption of an other-than-temporary impairment in such

cases may be overcome if there is evidence to support that the

decline is temporary in nature due to the existence of other

factors which overcome the duration or magnitude of the

decline. On the other hand, there may be cases where

impairment losses are recognized when the decline in the fair

value of the security is not more than 20% or such decline has

not existed for an extended period of time, as a result of

considering specific factors which may indicate the decline in

the fair value is other-than-temporary.

The assessment of whether a decline in the value of an

investment is other-than-temporary is often judgmental in nature

and involves certain assumptions and estimates concerning the

expected operating results, business plans and future cash

flows of the issuer of the security. Accordingly, it is possible that

investments in Sony’s portfolio that have had a decline in value

that Sony currently believes to be temporary may be determined

to be other-than-temporary in the future based on Sony’s

evaluation of additional information such as continued poor

operating results, future broad declines in value of worldwide

equity markets and the effect of world wide interest rate

fluctuations. As a result, unrealized losses recorded for

investments may be recognized into income in future periods.

The most significant portion of these unrealized losses relate

to investments held by Sony Life. Sony Life principally invests in

debt securities in various industries. Most securities were rated

“BBB” or better by Standard & Poor’s, Moody’s or others. As of

March 31, 2006, Sony Life had debt and equity securities which

had gross unrealized losses of ¥15.1 billion and ¥1.1 billion,

respectively. Of the unrealized loss amounts recorded by Sony

Life, less than 1% relate to securities being in an unrealized loss

position of greater than 12 months. These unrealized losses

related to numerous investments, with no single investment

being in a material unrealized loss position. In addition, there

was no individual security with unrealized losses that met the

test discussed above for impairment as the declines in value

were observed to be small both in amounts and percentage,

and therefore, the decline in value for those investments was still

determined to be temporary in nature.