Sysco 2012 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2012 Sysco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SYSCO CORPORATION-Form10-K50

PARTII

ITEM8Financial Statements and Supplementary Data

Long-Lived Assets

Management reviews long-lived assets for indicators of impairment whenever events or changes in circumstances indicate that the carrying value may not

be recoverable. Cash fl ows expected to be generated by the related assets are estimated over the asset’s useful life based on updated projections on an

undiscounted basis. If the evaluation indicates that the carrying value of the asset may not be recoverable, the potential impairment is measured at fair value.

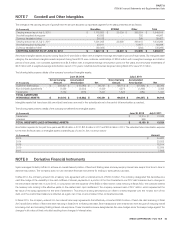

Goodwill and Intangibles

Goodwill and intangibles represent the excess of cost over the fair value of tangible net assets acquired. Goodwill and intangibles with indefi nite lives are

not amortized. Goodwill is assigned to the reporting units that are expected to benefi t from the synergies of a business combination. The recoverability of

goodwill and indefi nite-lived intangibles is assessed annually, or more frequently as needed when events or changes have occurred that would suggest an

impairment of carrying value, by determining whether the fair values of the applicable reporting units exceed their carrying values. The reporting units used

to assess goodwill impairment are the company’s nine operating segments as described in Note21, “Business Segment Information.” The components

within each of the nine operating segments have similar economic characteristics and therefore are aggregated into nine reporting units. The evaluation of

fair value requires the use of projections, estimates and assumptions as to the future performance of the operations in performing a discounted cash fl ow

analysis, as well as assumptions regarding sales and earnings multiples that would be applied in comparable acquisitions.

Intangibles with defi nite lives are amortized on a straight-line basis over their useful lives, which generally range from three to ten years. Management reviews

fi nite-lived intangibles for indicators of impairment whenever events or changes in circumstances indicate that the carrying value may not be recoverable.

Cash fl ows expected to be generated by the fi nite-lived intangibles are estimated over the intangible asset’s useful life based on updated projections on an

undiscounted basis. If the evaluation indicates that the carrying value of the fi nite-lived intangible asset may not be recoverable, the potential impairment

is measured at fair value.

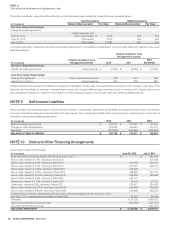

Restricted Cash

Sysco is required by its insurers to collateralize a part of the self-insured portion of its workers’ compensation and liability claims. Sysco has chosen to

satisfy these collateral requirements by depositing funds in insurance trusts or by issuing letters of credit. All amounts in restricted cash at June30,2012

and July2,2011 represented funds deposited in insurance trusts.

Derivative Financial Instruments

All derivatives are recognized as assets or liabilities within the consolidated balance sheets at fair value. Gains or losses on derivative fi nancial instruments

designated as fair value hedges are recognized immediately in the consolidated results of operations, along with the offsetting gain or loss related to the

underlying hedged item.

Gains or losses on derivative fi nancial instruments designated as cash fl ow hedges are recorded as a separate component of shareholders’ equity at

their settlement, whereby gains or losses are reclassifi ed to the Consolidated Results of Operations in conjunction with the recognition of the underlying

hedged item.

In the normal course of business, Sysco enters into forward purchase agreements for the procurement of fuel and electricity. Certain of these agreements

meet the defi nition of a derivative. However, the company elected to use the normal purchase and sale exemption available under derivatives accounting

literature; therefore, these agreements are not recorded at fair value.

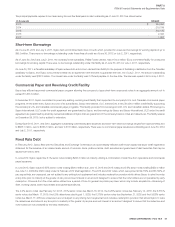

Investments in Corporate-Owned Life Insurance

Investments in corporate-owned life insurance (COLI) policies are recorded at their cash surrender values as of each balance sheet date. Changes in the

cash surrender value during the period are recorded as a gain or loss within operating expenses. The company does not record deferred tax balances related

to cash surrender value gains or losses for the policies that Sysco has the intent to hold these policies to maturity. Deferred tax balances are recorded for

those policies that Sysco intends to redeem prior to maturity. The total amounts related to the company’s investments in COLI policies included in other

assets in the consolidated balance sheets were $160.5million and $231.3million at June30,2012 and July2,2011, respectively.

Treasury Stock

The company records treasury stock purchases at cost. Shares removed from treasury are valued at cost using the average cost method.