Humana 2011 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2011 Humana annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

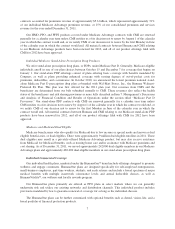

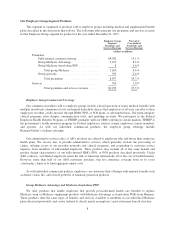

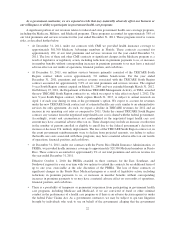

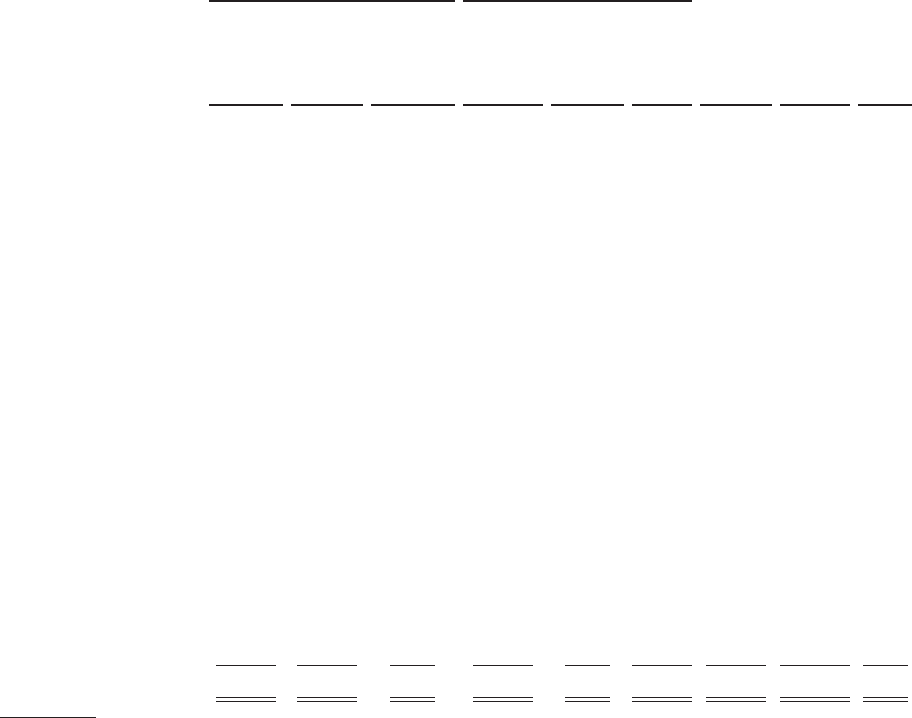

Membership

The following table summarizes our total medical membership at December 31, 2011, by market and

product:

Retail Segment Employer Group Segment

(in thousands)

Individual

Medicare

Advantage

Individual

Medicare

stand-

alone PDP

Individual

Commercial

Fully-

insured

commercial

Group

Group

Medicare

Advantage

and stand-

alone PDP ASO

Other

Businesses Total

Percent

of Total

Florida .............. 362.1 169.9 80.5 149.7 19.2 70.1 0 851.5 7.6%

Texas ............... 118.6 204.1 74.7 266.8 5.1 108.7 0 778.0 7.0%

Kentucky ............ 43.1 46.0 21.4 99.0 29.4 513.1 0 752.0 6.7%

Illinois .............. 64.5 82.7 37.8 170.7 5.6 118.9 (a) 0 480.2 4.3%

Ohio ................ 51.0 83.7 6.3 52.0 122.4 152.8 0 468.2 4.2%

Wisconsin ........... 44.4 48.8 15.4 82.8 12.3 142.9 0 346.6 3.1%

Georgia ............. 53.7 53.4 41.6 82.3 6.6 44.6 0 282.2 2.5%

Missouri/Kansas ...... 69.9 134.0 14.1 43.6 6.0 8.9 0 276.5 2.5%

Tennessee ........... 87.8 70.1 17.5 36.6 2.7 31.8 0 246.5 2.2%

California ........... 17.2 215.9 3.1 0.2 0 0 0 236.4 2.1%

Louisiana ............ 91.3 32.7 14.0 43.6 7.2 24.1 0 212.9 1.9%

Indiana .............. 42.1 67.9 5.9 20.3 3.5 47.9 0 187.6 1.7%

North Carolina ........ 62.1 91.4 6.4 0.2 1.9 0 0 162.0 1.5%

Michigan ............ 35.1 80.9 12.5 15.4 6.2 9.3 0 159.4 1.4%

Virginia ............. 57.8 72.9 3.7 0 2.5 0 0 136.9 1.2%

Arizona ............. 36.2 39.8 16.3 24.5 3.5 6.7 0 127.0 1.1%

Colorado ............ 21.8 35.4 34.1 19.2 5.1 0.4 0 116.0 1.0%

Military services ...... 0 0 0 0 0 0 1,722.9 1,722.9 15.4%

Military services

ASO.............. 0 0 0 0 0 0 1,305.2 1,305.2 11.7%

Medicaid and other .... 0 0 0 0 0 0 614.2 614.2 5.5%

LI-NET ............. 0 0 0 0 0 0 73.5 73.5 0.7%

Others .............. 381.6 1,010.8 87.9 73.3 55.6 39.7 0 1,648.9 14.7%

Totals ............... 1,640.3 2,540.4 493.2 1,180.2 294.8 1,319.9 3,715.8 11,184.6 100.0%

(a) Includes 27,600 Medicare Advantage ASO members.

Provider Arrangements

We provide our members with access to health care services through our networks of health care providers

with whom we have contracted, including hospitals and other independent facilities such as outpatient surgery

centers, primary care physicians, specialist physicians, dentists, and providers of ancillary health care services

and facilities. These ancillary services and facilities include ambulance services, medical equipment services,

home health agencies, mental health providers, rehabilitation facilities, nursing homes, optical services, and

pharmacies. Our membership base and the ability to influence where our members seek care generally enable us

to obtain contractual discounts with providers.

We use a variety of techniques to provide access to effective and efficient use of health care services for our

members. These techniques include the coordination of care for our members, product and benefit designs,

hospital inpatient management systems and enrolling members into various disease management programs. The

focal point for health care services in many of our HMO networks is the primary care physician who, under

contract with us, provides services to our members, and may control utilization of appropriate services by

directing or approving hospitalization and referrals to specialists and other providers. Some physicians may have

12