Humana 2011 Annual Report Download - page 84

Download and view the complete annual report

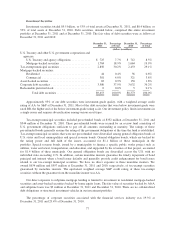

Please find page 84 of the 2011 Humana annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Premiums revenue and administrative services only, or ASO, fees are estimated by multiplying the

membership covered under the various contracts by the contractual rates. In addition, we adjust revenues for

estimated changes in an employer’s enrollment and individuals that ultimately may fail to pay, and beginning

January 1, 2011, for estimated rebates to policyholders under the minimum benefit ratios required under the

Health Insurance Reform Legislation. Enrollment changes not yet processed or not yet reported by an employer

group or the government, also known as retroactive membership adjustments, are estimated based on available

data and historical trends. We routinely monitor the collectibility of specific accounts, the aging of receivables,

historical retroactivity trends, estimated rebates, as well as prevailing and anticipated economic conditions, and

reflect any required adjustments in the current period’s revenue.

We bill and collect premium remittances from employer groups and members in our Medicare and other

individual products monthly. We receive monthly premiums from the federal government and various states

according to government specified payment rates and various contractual terms. Changes in revenues from CMS

for our Medicare products resulting from the periodic changes in risk-adjustment scores for our membership are

recognized when the amounts become determinable, based on the submission of diagnosis data to CMS, and the

collectibility is reasonably assured.

Medicare Part D Provisions

We cover prescription drug benefits in accordance with Medicare Part D under multiple contracts with

CMS. The payments we receive monthly from CMS and members, which are determined from our annual bid,

represent amounts for providing prescription drug insurance coverage. We recognize premiums revenue for

providing this insurance coverage ratably over the term of our annual contract. Our CMS payment is subject to

risk sharing through the Medicare Part D risk corridor provisions. In addition, receipts for reinsurance and

low-income cost subsidies as well as receipts for certain discounts on brand name prescription drugs in the

coverage gap represent payments for prescription drug costs for which we are not at risk.

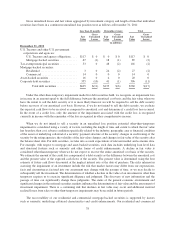

The risk corridor provisions compare costs targeted in our bids to actual prescription drug costs, limited to

actual costs that would have been incurred under the standard coverage as defined by CMS. Variances exceeding

certain thresholds may result in CMS making additional payments to us or require us to refund to CMS a portion

of the premiums we received. We estimate and recognize an adjustment to premiums revenue related to these risk

corridor provisions based upon pharmacy claims experience to date as if the annual contract were to terminate at

the end of the reporting period. Accordingly, this estimate provides no consideration to future pharmacy claims

experience. We record a receivable or payable at the contract level and classify the amount as current or long-

term in the consolidated balance sheets based on the timing of expected settlement.

The estimate of the settlement associated with risk corridor provisions requires us to consider factors that

may not be certain at period end, including member eligibility and risk adjustment score differences with CMS as

well as pharmacy rebates from manufacturers. These factors have an offsetting effect on changes in the risk

corridor estimate. In 2011, we paid $380 million related to our reconciliation with CMS regarding the 2010

Medicare Part D risk corridor provisions compared to our estimate of $388 million at December 31, 2010. In

2010, we paid $180 million related to our reconciliation with CMS regarding the 2009 Medicare Part D risk

corridor provisions compared to our estimate of $145 million at December 31, 2009. The net liability associated

with the 2011 risk corridor estimate, which will be settled in 2012, was $329 million at December 31, 2011.

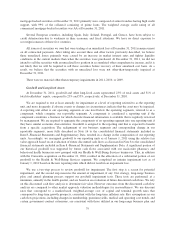

Reinsurance and low-income cost subsidies represent funding from CMS in connection with the Medicare

Part D program for which we assume no risk. Reinsurance subsidies represent funding from CMS for its portion

of prescription drug costs which exceed the member’s out-of-pocket threshold, or the catastrophic coverage level.

Low-income cost subsidies represent funding from CMS for all or a portion of the deductible, the coinsurance

and co-payment amounts above the out-of-pocket threshold for low-income beneficiaries. Monthly prospective

payments from CMS for reinsurance and low-income cost subsidies are based on assumptions submitted with our

annual bid. A reconciliation and related settlement of CMS’s prospective subsidies against actual prescription

drug costs we paid is made after the end of the year. Beginning in 2011, the Health Reform Legislation mandates

74