Sony 2005 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2005 Sony annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Sony Corporation 101

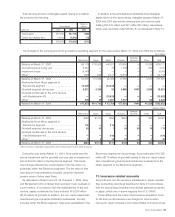

Fair value hedges

The derivatives designated as fair value hedges include interest

rate and currency swap agreements.

Both the derivatives designated as fair value hedges and

hedged items are reflected at fair value in the consolidated

balance sheet. Changes in the fair value of the derivatives

designated as fair value hedges as well as offsetting changes in

the carrying value of the underlying hedged items are recognized

in income.

The amount of ineffectiveness of these fair value hedges, that

was reflected in earnings, was not material for the years ended

March 31, 2003, 2004 and 2005. In addition, there were no

amounts excluded from the assessment of hedge effectiveness

of fair value hedges.

Cash flow hedges

The derivatives designated as cash flow hedges include foreign

exchange forward contracts, foreign currency option contracts

and interest rate and currency swap agreements.

Changes in the fair value of derivatives designated as cash

flow hedges are initially recorded in other comprehensive income

and reclassified into earnings when the hedged transaction

affects earnings. For the years ended March 31, 2003 and

2004, these cash flow hedges were fully effective. For the year

ended March 31, 2005, the amount of ineffectiveness of these

cash flow hedges that was reflected in earnings was not mate-

rial. In addition, there were no amounts excluded from the

assessment of hedge effectiveness of cash flow hedges. At

March 31, 2005, amounts related to derivatives qualifying as

cash flow hedges amounted to a net reduction of equity of

¥2,490 million ($23 million). Within the next twelve months,

¥1,615 million ($15 million) is expected to be reclassified from

equity into earnings as loss. For the year ended March 31,

2005, there were no forecasted transactions that failed to occur

which resulted in the discontinuance of cash flow hedges.

Derivatives not designated as hedges

The derivatives not designated as hedges under FAS No. 133

include foreign exchange forward contracts, foreign currency

option contracts, interest rate and currency swap agreements,

convertible rights included in convertible bonds and other.

Changes in the fair value of derivatives not designated as

hedges are recognized in income.

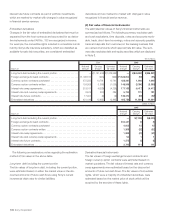

A description of the purpose and classification of the deriva-

tive financial instruments held by Sony is as follows:

Foreign exchange forward contracts and foreign currency option

contracts

Sony enters into foreign exchange forward contracts and pur-

chased and written foreign currency option contracts primarily to

fix the cash flows from intercompany accounts receivable and

payable and forecasted transactions denominated in functional

currencies (Japanese yen, U.S. dollars and euros) of Sony’s

major operating units. The majority of written foreign currency

option contracts are a part of range forward contract arrange-

ments and expire in the same month with the corresponding

purchased foreign currency option contracts.

Sony also enters into foreign exchange forward contracts,

which effectively fix the cash flows from foreign currency

denominated debt. Accordingly, these derivatives have been

designated as cash flow hedges in accordance with FAS

No. 133.

Foreign exchange forward contracts and foreign currency

option contracts that do not qualify as hedges are marked-

to-market with changes in value recognized in other income

and expenses.

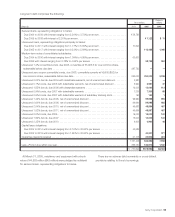

Interest rate and currency swap agreements

Sony enters into interest rate and currency swap agreements,

which are used for reducing the risk arising from the changes in

the fair value of fixed rate debt and available-for-sale debt

securities. For example, Sony enters into interest rate and

currency swap agreements, which effectively swap foreign

currency denominated fixed rate debt for functional currency

denominated variable rate debt. These derivatives are consid-

ered to be a hedge against changes in the fair value of Sony’s

foreign denominated fixed-rate obligations. Accordingly, these

derivatives have been designated as fair value hedges in accor-

dance with FAS No. 133.

Sony also enters into interest rate and currency swap agree-

ments that are used for reducing the risk arising from the

changes in anticipated cash flow of variable rate debt and

foreign currency denominated debt. For example, Sony enters

into interest rate and currency swap agreements, which effec-

tively swap foreign currency denominated variable rate debt for

functional currency denominated fixed rate debt. These deriva-

tives are considered to be a hedge against changes in the

anticipated cash flow of Sony’s foreign denominated variable

rate obligations. Accordingly, these derivatives have been desig-

nated as cash flow hedges in accordance with FAS No. 133.

Certain subsidiaries in the Financial Services segment have

interest rate swap agreements as part of portfolio investments,

which are marked-to-market with changes in value recognized

in financial service revenue.

Any other interest rate and currency swap agreements that do

not qualify as hedges, which are used for reducing the risk

arising from changes of variable rate and foreign currency

dominated intercompany debt, are marked-to-market with

changes in value recognized in other income and expenses.

Interest rate future contracts

Certain subsidiaries in the Financial Services segment have

BH6/30 Adobe PageMaker 6.0J /PPC