Sony 2005 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2005 Sony annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

118 Sony Corporation

During the year ended March 31, 2005, a corporation size-

based enterprise tax was introduced in Japan and the portion

of enterprise tax subject to income was reduced. As a result,

the statutory tax rate for the year ended March 31, 2005 was

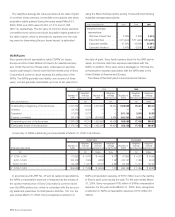

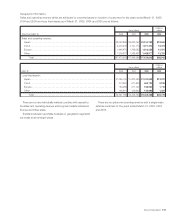

Reconciliation of the differences between the statutory tax rate and the effective income tax rate is as follows:

Years ended March 31 2003 2004 2005

Statutory tax rate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

42.0% 43.9% 41.0%

Increase (reduction) in taxes resulting from:

Income tax credits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(1.9) (2.4) (0.1)

Change in valuation allowances . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5.5 6.5 (22.7)

Decrease in deferred tax liabilities on undistributed earnings of foreign subsidiaries . . . . . . . . . . . . .

(14.8) (9.2) (4.0)

Lower tax rate applied to life and non-life insurance business in Japan. . . . . . . . . . . . . . . . . . . . . . .

(0.6) (2.6) (1.9)

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2.4 0.4 (2.1)

Effective income tax rate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

32.6% 36.6% 10.2%

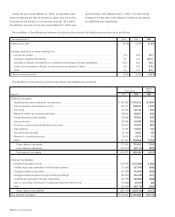

The significant components of deferred tax assets and liabilities are as follows:

Dollars in

Yen in millions millions

March 31 2004 2005 2005

Deferred tax assets:

Operating loss carryforwards for tax purposes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

¥(196,308 ¥(193,212 $(1,806

Accrued pension and severance costs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

150,073 159,610 1,492

Film costs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

54,194 56,746 530

Warranty reserve and accrued expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

45,664 56,551 529

Future insurance policy benefits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

35,855 36,654 343

Accrued bonus . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

36,285 34,536 323

Inventory—intercompany profits and write-down . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

30,241 30,270 283

Depreciations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14,108 15,320 143

Tax credit carryforwards . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13,740 8,552 80

Reserve for doubtful accounts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14,005 6,574 61

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

141,731 153,525 1,434

Gross deferred tax assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

732,204 751,550 7,024

Less: Valuation allowance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(127,577) (89,110) (833)

Total deferred tax assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

604,627 662,440 6,191

Deferred tax liabilities:

Insurance acquisition costs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(125,768) (135,083) (1,262)

Unbilled accounts receivable in the Pictures business . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(71,586) (57,314) (536)

Unrealized gains on securities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(45,239) (41,564) (388)

Intangible assets acquired through exchange offerings . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(36,490) (35,418) (331)

Undistributed earnings of foreign subsidiaries . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(44,778) (30,865) (288)

Gain on securities contribution to employee retirement benefit trust . . . . . . . . . . . . . . . . . . . . . . . . .

(16,899) (6,184) (58)

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(39,435) (58,714) (550)

Gross deferred tax liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(380,195) (365,142) (3,413)

Net deferred tax assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

¥(224,432 ¥(297,298 $(2,778

approximately 41% effective April 1, 2004. The effect of the

change in the tax rate on the balance of deferred tax assets

and liabilities was insignificant.

BH6/30 Adobe PageMaker 6.0J /PPC