Sony 2005 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2005 Sony annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Sony Corporation 131

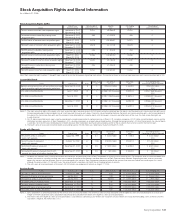

Stock Acquisition Rights and Bond Information

As of March 31, 2005

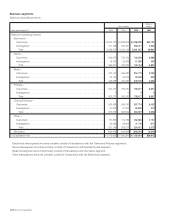

Stock Acquisition Rights (SARs)

Date of issue Total number of Exercise Outstanding Percentage of

Name (Exercise period) SARs to be issued price balance SARs exercised (%)

The first series of common stock acquisition rights December 9, 2002 12,004 ¥5,396.00 12,004 0

(December 8, 2012)

The second series of subsidiary tracking stock December 9, 2002 455 ¥1,008.00 455 0

acquisition rights (December 8, 2012)

The third series of common stock acquisition rights March 31, 2003 14,475 U.S.$36.57 14,201 1.9

(March 31, 2013)

The fourth series of common stock acquisition rights November 14, 2003 13,978 ¥4,101.00 13,978 0

(November 13, 2013)

The fifth series of subsidiary tracking stock November 14, 2003 455 ¥ 815.00 455 0

acquisition rights (November 13, 2013)

The sixth series of common stock acquisition rights March 31, 2004 12,236 U.S.$40.90 12,236 0

(March 31, 2014)

The seventh series of common stock acquisition rights November 18, 2004 14,242 ¥3,782.00 14,242 0

(November 17, 2014)

The eighth series of subsidiary tracking stock November 18, 2004 455 ¥1,259.00 455 0

acquisition rights (November 17, 2014)

The ninth series of common stock acquisition rights March 31, 2005 10,094 U.S.$40.34 10,094 0

(March 31, 2015)

Note: Stock acquisition rights numbers 1 through 9 were issued at no cost for the purpose of granting stock options. The number of shares to be issued upon exercise of each stock acquisition right is 100.

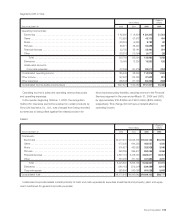

Convertible Bonds

Interest rate Total amount Conversion Outstanding balance

Name Date of issue Years (%) of issue price (Percentage of bonds converted)

Euroyen-denominated notes with convertible bond-type December 18, 2003 5 0 ¥250,000.million ¥ 5,605.0 ¥250,000.million

stock acquisition rights and conversion restrictions (0%)

U.S. dollar convertible bonds April 17, 2000 10 0 U.S.$57,331.thousand ¥13,220.0 U.S.$47,665.thousand

(0%)

U.S. dollar convertible bonds April 16, 2001 10 0 U.S.$77,056.thousand ¥ 8,814.0 U.S.$53,307.thousand

(0%)

U.S. dollar convertible bonds December 17, 2001 5 0 U.S.$57,307.thousand ¥5,952.23 U.S.$56,492.thousand

(0%)

U.S. dollar convertible bonds April 15, 2002 10 0 U.S.$67,297.thousand ¥ 6,931.0 U.S.$43,073.thousand

(0%)

Notes: 1. The stock acquisition rights of the bonds with stock acquisition rights (principal amount of ¥250 billion) cannot be detached from the bonds, and the exercise of a stock acquisition right causes

the corresponding bond to be canceled in lieu of a cash payment for purchase of shares. Due to this close interrelation between the bonds and stock acquisition rights, and in consideration of

the value of the stock acquisition rights and the economic value obtainable by issuing the bonds with the coupon, issue price and other terms of the issue, the stock acquisition rights are

issued at no cost.

2. All U.S. dollar convertible bonds were issued to provide equity-based compensation to certain executives in Sony’s U.S. subsidiary companies. All U.S. dollar convertible bonds were issued for

distribution to certain executives in Sony Corporation’s U.S. subsidiary companies as an equity-based incentive plan. Although the conversion ratio is 0% for all these bonds, the value of bonds

issued does not match the outstanding balance of bonds because Sony Corporation purchased and canceled a portion of these warrants that were not used for the incentive plan.

3. The fourth series of unsecured convertible bonds (outstanding balance: ¥5,008 million) was redeemed at maturity on March 31, 2005..

Bonds with Warrants

Interest rate Total amount Conversion Outstanding balance

Name Date of issue Years (%) of issue price (Percentage of warrants exercised)

The seventh series of unsecured August 23, 1999 6 0.1 ¥ 4,000 million ¥ 7,166.5 ¥ 4,000 million

bonds with warrants (0%)

The tenth series of unsecured October 19, 2000 6 1.55 ¥12,000 million ¥12,457.0 ¥11,490 million

bonds with warrants (0%)

The thirteenth series of unsecured December 21, 2001 6 0.9 ¥ 7,300 million ¥ 6,039.0 ¥ 6,920 million

bonds with warrants (0%)

The fourteenth series of unsecured bonds with December 21, 2001 6 0.9 ¥ 150 million ¥ 3,300.0 ¥ 150 million

warrants for shares of subsidiary tracking stock (0%)

Notes: 1. All bonds with warrants were issued for distribution to the directors and other executives of Sony Corporation as an equity-based incentive plan. The fourteenth series of unsecured bonds with

warrants for shares of subsidiary tracking stock was issued for distribution to the directors and other executives of Sony Communication Network. Regarding the tenth series of unsecured

bonds with warrants and the thirteenth series of unsecured bonds with warrants, Sony Corporation canceled a portion of the warrants that were not used for the incentive plan. As a result,

although the exercise ratio is 0% for both issues, the value of bonds issued does not match the outstanding balance of warrants.

2. The sixth series of unsecured bonds with warrants (¥4,000 million) was redeemed at maturity on August 17, 2004.

Straight Bonds

Name Date of issue Years Interest rate (%) Total amount of issue Outstanding balance

The sixth (2) series of unsecured bonds October 23, 1998 7 2.00 ¥ 15,000 million ¥ 15,000 million

The seventh (2) series of unsecured bonds July 26, 2000 7 1.99 ¥ 15,000 million ¥ 15,000 million

The eighth (2) series of unsecured bonds July 26, 2000 10 (Note 2) ¥ 5,000 million ¥ 4,900 million

The eighth series of unsecured bonds September 13, 2000 5 1.42 ¥100,000 million ¥100,000 million

The ninth series of unsecured bonds September 13, 2000 10 2.04 ¥ 50,000 million ¥ 50,000 million

The eleventh series of unsecured bonds September 17, 2001 5 0.64 ¥100,000 million ¥100,000 million

The twelfth series of unsecured bonds September 17, 2001 10 1.52 ¥ 50,000 million ¥ 50,000 million

Notes: 1. Sony Corporation assumed responsibility for the sixth (2) series of unsecured bonds, the seventh (2) series of unsecured bonds and the eighth (2) series of unsecured bonds as a result of its

merger with AIWA Corporation. Sony Corporation repurchased and canceled ¥100 million of the eighth (2) series of unsecured bonds.

2. The interest rate of the eighth (2) series of unsecured bonds is calculated by subtracting 2-year interest rate swap from 20-year interest rate swap and then adding 1.00%. (If the result of this

calculation is negative, the interest rate is 0%.)

BH6/30 Adobe PageMaker 6.0J /PPC