Sony 2005 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2005 Sony annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

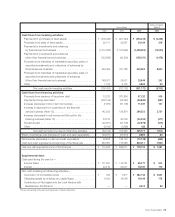

88 Sony Corporation

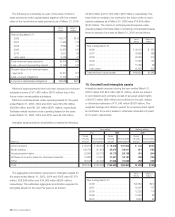

Dollars in

Yen in millions millions

Years ended March 31 2003 2004 2005 2005

Income before cumulative effect of an accounting change allocated to common stock:

As reported . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

¥115,648 ¥90,756 ¥168,498 $1,575

Deduct: Total stock-based compensation expense determined

Deduct: under the fair value based method, net of related tax effects . . . . . . . . . . . . . . .

(7,008) (6,334) (4,690) (44)

Pro forma . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

¥108,640 ¥84,422 ¥163,808 $1,531

Net income allocated to common stock:

As reported . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

¥115,648 ¥88,639 ¥163,785 $1,531

Deduct: Total stock-based compensation expense determined

Deduct: under the fair value based method, net of related tax effects . . . . . . . . . . . . . . .

(7,008) (6,334) (4,690) (44)

Pro forma . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

¥108,640 ¥82,305 ¥159,095 $1,487

YenDollars

Years ended March 31 2003 2004 2005 2005

Income before cumulative effect of an accounting change allocated to common stock:

Basic EPS:

As reported . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

¥125.74.¥98.26.¥180.96.$1.69.

Pro forma . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

118.12.91.40.175.92.1.64.

Diluted EPS:

As reported . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

¥118.21.¥89.03.¥162.59.$1.52.

Pro forma . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

111.20.82.96.158.10.1.48.

Net income allocated to common stock:

Basic EPS:

As reported . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

¥125.74.¥95.97.¥175.90.$1.64.

Pro forma . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

118.12.89.11.170.86.1.60.

Diluted EPS:

As reported . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

¥118.21.¥87.00.¥158.07.$1.48.

Pro forma . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

111.20.80.94.153.58.1.44.

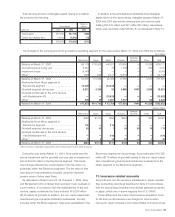

Sony formally documents all hedging relationships between

the derivatives designated as hedges and hedged items, as well

as its risk management objectives and strategies for undertaking

various hedging activities. Sony links all hedges that are desig-

nated as fair value or cash flow hedges to specific assets or

liabilities on the balance sheet or to the specific forecasted

transaction. Sony also assesses, both at the inception of the

hedge and on an on-going basis, whether the derivatives that

are designated as hedges are highly effective in offsetting

changes in fair value or cash flows of hedged items. When it is

determined that a derivative is not highly effective as a hedge,

Sony discontinues hedge accounting.

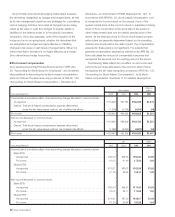

■ Stock-based compensation

Sony applies Accounting Principle Board Opinion (“APB”) No.

25, “Accounting for Stock Issued to Employees”, and its related

interpretations in accounting for its stock-based compensation

plans and follows the disclosure-only provisions of FAS No. 148,

“Accounting for Stock-Based Compensation—Transition and

Disclosure—an Amendment of FASB Statement No. 123”. In

accordance with APB No. 25, stock-based compensation cost

is recognized in income based on the excess, if any, of the

quoted market price of the common stock or subsidiary tracking

stock of Sony Corporation at the grant date of the award or

other measurement date over the stated exercise price of the

award. As the exercise prices for Sony’s stock-based compen-

sation plans are generally determined based on the prevailing

market price shortly before the date of grant, the compensation

expense for these plans is not significant. For awards that

generate compensation expense as defined under APB No. 25,

Sony calculates the amount of compensation expense and

recognizes the expense over the vesting period of the award.

The following table reflects the net effect on net income and

net income per share allocated to the common stock if Sony

had applied the fair value recognition provisions of FAS No. 123,

“Accounting for Stock-Based Compensation”, to its stock-

based compensation. See Note 17 for detailed assumptions.

BH6/30 Adobe PageMaker 6.0J /PPC