Cabela's 2009 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2009 Cabela's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

6

Our bank subsidiary is a Federal Deposit Insurance Corporation (“FDIC”) insured, special purpose, Nebraska

state-chartered bank. Our bank’s charter limits us to issuing consumer credit cards and certificates of deposit of

$100,000 or more. Our bank does not accept demand deposits or make non-credit card loans. During 2009, we had

an average of 1,244,621 active credit card accounts with an average balance of $1,857 compared to an average of

1,140,834 active credit card accounts with an average balance of $1,828 during 2008.

Cabela’s CLUB Visa Card Loyalty Program. The Cabela’s CLUB Visa card loyalty program is a rewards-

based credit card program, which we believe has increased brand loyalty among our customers and has helped reduce

customer attrition in our merchandising businesses. Our rewards program is a simple loyalty program that allows

customers to earn points whenever and wherever they use their credit card and then redeem earned points for products

and services at our retail stores or through our Direct business. Our rewards program is integrated into our store point

of sale system which adds to the convenience of the rewards program as our employees can inform customers of their

number of accumulated points when making purchases at our stores. The percentage of our merchandise sales that

were made on the Cabela’s CLUB card was 27.9% for 2009 compared to 27.5% for 2008.

Financial Services Marketing. We adhere to a low cost, efficient, and tailored credit card marketing program

that leverages the Cabela’s brand name. We market the Cabela’s CLUB Visa card through a number of channels,

including retail stores, inbound telemarketing, catalogs, and the Internet. Customer service representatives at our

customer care centers offer the Cabela’s CLUB Visa card to qualifying customers. This card is marketed throughout

our catalogs and our Internet site. Our customers can apply for the Cabela’s CLUB Visa card at our retail stores and

website through our instant credit process and, if approved, receive reward points available for use on merchandise

purchases the same day. When a customer’s application is approved through the retail store instant credit process, the

customer’s new credit card is produced and given to the customer immediately thereafter. Maintaining the growth of

our credit card program, while continuing to underwrite high-quality customers and actively manage our credit card

delinquencies and charge-offs, is key to the successful performance of our Financial Services business. Our Financial

Services growth is dependent, in part, on the success of our Retail and Direct businesses to generate additional sales

and to attract additional Financial Services customers.

Underwriting and Credit Criteria. We underwrite high-quality credit customers and have historically

maintained attractive credit statistics compared to industry averages. We adhere to strict credit policies and target

high credit quality obligors. The scores of Fair Isaac Corporation (“FICO”) are a widely-used tool for assessing

a person’s credit rating. Our cardholders had a median FICO score of 787 at the end of 2009 compared to 786 at

the end of 2008. We believe the median FICO scores of our cardholders are well above the industry average. Our

charge-offs as a percentage of total outstanding balances were 5.06% in 2009, which we believe is well below the

2009 industry average.

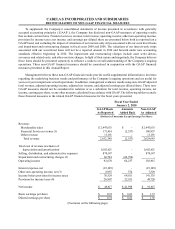

The table below presents data on our credit card portfolio’s performance comparing the last three years and

illustrates the high credit quality of our managed credit card portfolio.

As a Percentage of Managed Loans: 2009 2008 2007

Delinquencies greater than 30 days 1.79%1.68%0.97%

Gross charge-offs 5.52 3.40 2.53

Net charge-offs 5.06 2.95 2.01

Products and Merchandising

We offer our customers a comprehensive selection of high-quality, competitively priced, national and regional

brand products, including our own Cabela’s brand. Our product assortment includes merchandise and equipment

for hunting, fishing, marine use, and camping, along with casual and outdoor apparel and footwear, optics, vehicle

accessories, gifts and home furnishings with an outdoor theme, and furniture restoration related merchandise.