Humana 2010 Annual Report Download - page 64

Download and view the complete annual report

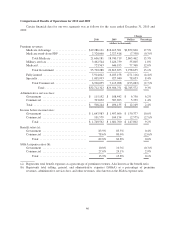

Please find page 64 of the 2010 Humana annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Medicare benefit ratio. The decline in the Medicare benefit ratio primarily resulted from a substantial decline in

Medicare stand-alone PDP benefit expenses as a result of our competitive positioning as we realigned stand-

alone PDP premium and benefit designs to correspond with our historical prescription drug claims experience.

The Commercial segment’s benefit expenses increased $36.3 million, or 0.6%, during 2009 compared to

2008 primarily due to the OSF and Cariten acquisitions in the second and fourth quarters of 2008, respectively.

The benefit ratio for the Commercial segment of 80.6% for 2009 increased 30 basis points from the 2008 benefit

ratio of 80.3%, primarily reflecting higher utilization associated with the general economy and the highly

competitive environment, as well as the impact of the H1N1 virus, partially offset by an increase in per member

premiums. We experienced higher utilization of benefits in our fully-insured group accounts as in-group attrition,

primarily as a result of reductions of less experienced workers, has led to a shift in the mix of members to an

older workforce having more health care needs, as well as members utilizing more benefits ahead of actual or

perceived layoffs, members seeking to maximize their benefits once their deductibles are met, and increased

COBRA participation.

SG&A Expense

Consolidated SG&A expenses increased $282.9 million, or 7.2%, during 2009 compared to 2008. The

increase primarily resulted from an increase in the average number of our employees due to the Medicare growth

and higher average individual product membership. The average number of our employees increased 1,600 to

28,500 for 2009 from 26,900 for 2008, or 5.9%.

The consolidated SG&A expense ratio for 2009 was 13.8%, increasing 10 basis points from 13.7% for 2008

primarily due to an increase in the Commercial segment SG&A expense ratio as discussed below.

SG&A expenses in the Government segment increased $137.0 million, or 6.2%, during 2009 compared to

2008. The Government segment SG&A expense ratio decreased 30 basis points from 10.6% for 2008 to 10.3%

for 2009. The decrease primarily resulted from efficiency gains associated with servicing higher average

Medicare Advantage membership. For example, during 2009 we transitioned the recently acquired OSF and

Metcare members into our primary Medicare service platform and eliminated the cost of having duplicate

platforms.

Commercial segment SG&A expenses increased $145.9 million, or 8.5%, during 2009 compared to 2008.

The Commercial segment SG&A expense ratio increased 170 basis points from 22.4% for 2008 to 24.1% for

2009. The increase primarily was due to administrative costs associated with increased business for our mail-

order pharmacy and higher average individual product membership. Average individual product membership

increased 17.6% during 2009 compared to 2008. Individual accounts bear a higher SG&A expense ratio due to

higher distribution costs as compared to larger accounts.

Depreciation and Amortization

Depreciation and amortization for 2009 totaled $250.3 million compared to $220.4 million for 2008, an

increase of $29.9 million, or 13.6%, primarily reflecting depreciation expense associated with capital

expenditures since December 31, 2008.

Interest Expense

Interest expense was $105.8 million for 2009, compared to $80.3 million for 2008, an increase of $25.5

million, primarily due to higher interest rates and higher average outstanding debt. In the second quarter of 2008,

we issued $500 million of 7.20% senior notes due June 15, 2018 and $250 million of 8.15% senior notes due

June 15, 2038, the proceeds of which were used for the repayment of the outstanding balance under our credit

agreement. The weighted average effective interest rate for all of our long-term debt was 5.97% for 2009 and

4.73% for 2008.

54