Electronic Arts 2015 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2015 Electronic Arts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

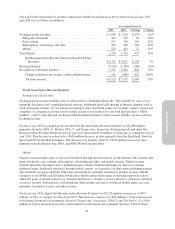

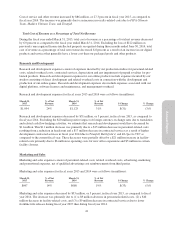

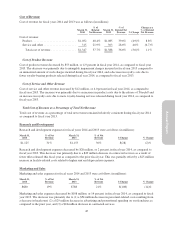

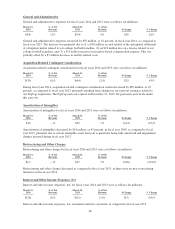

General and Administrative

General and administrative expenses consist of personnel and related expenses of executive and administrative

staff, corporate functions such as finance, legal, human resources, and information technology (“IT”), related

overhead costs, fees for professional services such as legal and accounting, and allowances for doubtful accounts.

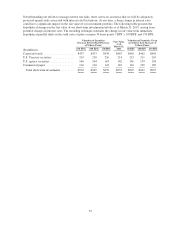

General and administrative expenses for fiscal years 2015 and 2014 were as follows (in millions):

March 31,

2015

% of Net

Revenue

March 31,

2014

% of Net

Revenue $ Change % Change

$386 9% $410 11% $(24) (6)%

General and administrative expenses decreased by $24 million, or 6 percent, in fiscal year 2015, as compared to

fiscal year 2014, primarily due to a $30 million expense related to the settlement of a litigation matter during the

fiscal year ended March 31, 2014 and an $23 million decrease in costs incurred on a license, both related to our

college football franchise. This was partially offset by an $11 million increase primarily related to other litigation

matters and a $16 million increase in personnel-related costs during the fiscal year ended March 31, 2015.

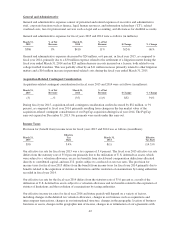

Acquisition-Related Contingent Consideration

Acquisition-related contingent consideration for fiscal years 2015 and 2014 were as follows (in millions):

March 31,

2015

% of Net

Revenue

March 31,

2014

% of Net

Revenue $ Change % Change

(3) —% (35) (1)% $32 91%

During fiscal year 2015, acquisition-related contingent consideration credits decreased by $32 million, or 91

percent, as compared to fiscal year 2014, primarily resulting from changes in the fair market value of the

acquisition-related contingent consideration of our PopCap acquisition during fiscal year 2014. The PopCap

earn-out expired on December 31, 2013. No payments were made under this earn-out.

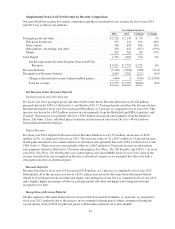

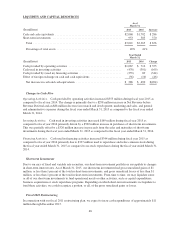

Income Taxes

Provision for (benefit from) income taxes for fiscal years 2015 and 2014 was as follows (in millions):

March 31,

2015

Effective

Tax

Rate

March 31,

2014

Effective

Tax Rate

$50 5.4% $(1) (14.3)%

Our effective tax rate for fiscal year 2015 was a tax expense of 5.4 percent. The fiscal year 2015 effective tax rate

differs from the statutory rate of 35.0 percent primarily due to the utilization of U.S. deferred tax assets, which

were subject to a valuation allowance, excess tax benefits from stock-based compensation deductions allocated

directly to contributed capital, and non-U.S. profits subject to a reduced or zero tax rates. The provision for

income taxes for fiscal year 2015 differs from the benefit from income taxes for fiscal year 2014 primarily due to

benefits related to the expiration of statutes of limitations and the resolution of examinations by taxing authorities

recorded in fiscal year 2014.

Our effective tax rate for the fiscal year 2014 differs from the statutory rate of 35.0 percent as a result of the

utilization of U.S. deferred tax assets subject to a valuation allowance and tax benefits related to the expiration of

statutes of limitations and the resolution of examinations by taxing authorities.

Our effective income tax rates for fiscal year 2016 and future periods will depend on a variety of factors,

including changes in the deferred tax valuation allowance, changes in our business such as acquisitions and

intercompany transactions, changes in our international structure, changes in the geographic location of business

functions or assets, changes in the geographic mix of income, changes in or termination of our agreements with

42