Electronic Arts 2015 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2015 Electronic Arts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180

|

|

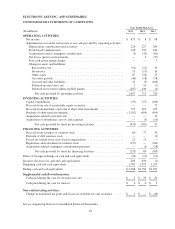

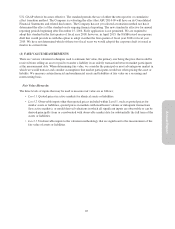

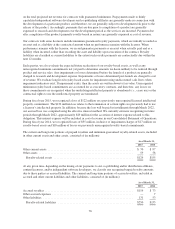

Assets and Liabilities Measured at Fair Value on a Recurring Basis

As of March 31, 2015 and 2014, our assets and liabilities that were measured and recorded at fair value on a

recurring basis were as follows (in millions):

Fair Value Measurements at Reporting

Date Using

As of

March 31,

2015

Quoted

Prices in

Active

Markets for

Identical

Financial

Instruments

Significant

Other

Observable

Inputs

Significant

Unobservable

Inputs

(Level 1) (Level 2) (Level 3) Balance Sheet Classification

Assets

Bank and time deposits ................ $ 175 $175 $ — $— Cash equivalents

Money market funds .................. 7 7 — — Cash equivalents

Available-for-sale securities:

Corporate bonds ................... 468 — 468 — Short-term investments and

cash equivalents

U.S. Treasury securities ............. 214 214 — — Short-term investments

U.S. agency securities ............... 180 — 180 — Short-term investments and

cash equivalents

Commercial paper .................. 140 140 Short-term investments and

cash equivalents

Foreign currency derivatives ............ 18 — 18 — Other current assets

Deferred compensation plan assets(a) ..... 9 9 — — Other assets

Total assets at fair value ............. $1,211 $405 $806 $—

Liabilities

Contingent consideration(b) ............. $ — $ — $ — $— Accrued and other current

liabilities

Foreign currency derivatives ............ 9 — 9 — Accrued and other current

liabilities

Deferred compensation plan liabilities(a) . . . 9 9 — — Other liabilities

Total liabilities at fair value .......... $ 18 $ 9 $ 9 $—

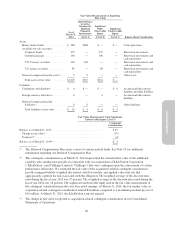

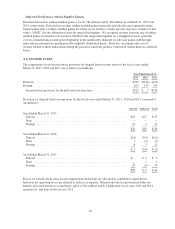

Fair Value Measurements Using

Significant Unobservable Inputs (Level 3)

Contingent

Consideration

Balance as of March 31, 2014 ...................................... $ 4

Change in fair value(c) ........................................... (3)

Payments(d) ................................................... (1)

Balance as of March 31, 2015(b) ..................................... $—

68