Philips 2007 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2007 Philips annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Philips Annual Report 2007 111

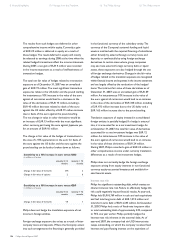

Country decomposition of the 5% NPPC at risk

in millions of euros

(100)

(50)

0

500

100

150

200

250

2006 20061) 20071) 2) 20071) 3)

total risk

diversification

Netherlands

US

Germany

UK

1) adjusted economic modeling

2) including plan and investment policy changes in 2007

3) including target investment policy 2008

Fiscal

Philips is, as mentioned before, exposed to scal

uncertainties. This section further describes this exposure.

Transfer pricing uncertainties

Philips has issued transfer pricing directives, which are

in accordance with guidelines of the Organization of

Economic Co-operation and Development. As transfer

pricing has a cross-border effect, the focus of local tax

authorities on implemented transfer pricing procedures

in a country may have an impact on results in another

country. In order to mitigate the transfer pricing

uncertainties, audits are executed on a regular basis

to safeguard the correct implementation of the transfer

pricing directives.

Tax uncertainties on general service agreements

and speci c allocation contracts

Due to the centralization of certain activities in a limited

number of countries (such as research and development

costs, centralized costs for IT, and costs for corporate

functions and head of ce), costs are also centralized.

As a consequence, for tax reasons these costs and / or

revenues must be allocated to the bene ciaries, i.e. the

various Philips entities. For that purpose, apart from

speci c allocation contracts for costs and revenues,

general service agreements (GSAs) are signed with

a large number of entities. Tax authorities review

the implementation of GSAs, often auditing on bene t

test for a particular country or the use of tax credits

attached to GSAs and royalty payments, and may reject

the implemented procedures. Furthermore, buy in/out

situations in the case of (de)mergers could affect the tax

allocation of GSAs between countries. The same applies

to the speci c allocation contracts.

Tax uncertainties due to disentanglements and acquisitions

When a subsidiary of Philips is disentangled, or a new

company is acquired, related tax uncertainties arise.

Philips creates merger and acquisition (M&A) teams for

these disentanglements or acquisitions. These teams

consist of specialists from various corporate functions

and are formed, amongst other things, to identify hidden

tax uncertainties that could subsequently surface when

companies are acquired and to avoid tax claims related

to disentangled entities. These tax uncertainties are

investigated and assessed to mitigate tax uncertainties

in the future as much as possible. Several tax uncertainties

may surface from M&A activities. Examples of uncertainties

are: applicability of the participation exemption, allocation

issues, and non-deductibility of parts of the purchase price.

Tax uncertainties due to permanent establishments

In countries where Philips starts new operations, the

issue of permanent establishment may arise. This is due

to the fact that when operations in new countries are led

from other countries, there is a risk that tax claims will

arise in the new country as well as in the initial country.

Philips assesses these uncertainties before the new

activities are started in a particular country.

Tax uncertainties of losses carried forward and tax credits

carried forward

The value of the losses carried forward is not only a matter

of having suf cient pro ts available within the loss-carried

forward period, but also a matter of suf cient pro ts

within the foreseeable future in the case of losses

carried forward with an inde nite carryforward period.

Valuation allowances of deferred tax asset positions are

in place where considered necessary.

Legal

Please refer to note 27 for additional disclosure relating

to speci c legal proceedings.

98 Risk management 112 Our leadership 116 Report of the Supervisory Board 126 Financial Statements