Yahoo 2015 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2015 Yahoo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

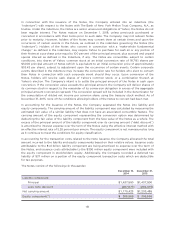

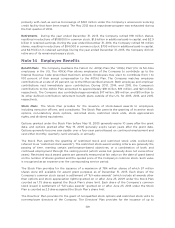

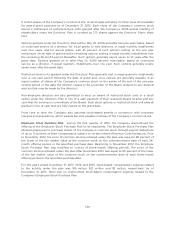

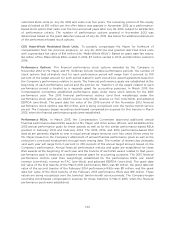

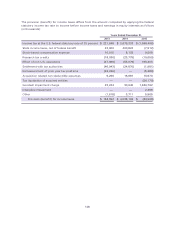

Stock Options. The Company’s Stock Plan, the Directors’ Plan, and stock-based awards assumed

through acquisitions (including stock-based commitments related to continued service of acquired

employees, such as holdbacks by Yahoo of shares of Yahoo common stock issued to founders of

acquired companies in connection with certain of the Company’s acquisitions) are collectively

referred to as the “Plans”. Stock option activity under the Company’s Plans for the year ended

December 31, 2015 is summarized as follows (in thousands, except years and per share amounts):

Shares

Weighted

Average

Exercise

Price per

Share

Weighted

Average

Remaining

Contractual

Life

(in years)

Aggregate

Intrinsic Value

Outstanding at December 31, 2014(1)

9,225 $18.57 4.33 $274,072

Options granted

—$—

Options assumed in acquisitions

407 $11.89

Options exercised(2)

(2,168) $16.23

Options expired

(585) $19.09

Options cancelled/forfeited

(357) $19.75

Outstanding at December 31, 2015(1)

6,522 $18.82 4.03 $103,230

Vested and expected to vest, at December 31, 2015(3)

6,338 $17.48 3.98 $100,310

Exercisable at December 31, 2015

3,925 $17.40 3.42 $ 62,553

(1) Includes shares subject to performance-based stock options for which performance goals had

not been set as of the date shown.

(2) The Company generally issues new shares to satisfy stock option exercises.

(3) The expected to vest options are the result of applying the pre-vesting forfeiture rate

assumptions to total outstanding options.

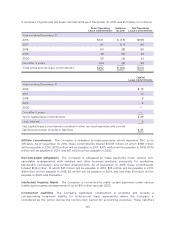

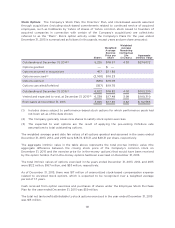

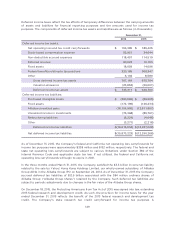

The weighted average grant date fair values of all options granted and assumed in the years ended

December 31, 2013, 2014, and 2015 were $18.72, $31.31, and $20.31 per share, respectively.

The aggregate intrinsic value in the table above represents the total pre-tax intrinsic value (the

aggregate difference between the closing stock price of the Company’s common stock on

December 31, 2015 and the exercise price for in-the-money options) that would have been received

by the option holders if all in-the-money options had been exercised on December 31, 2015.

The total intrinsic values of options exercised in the years ended December 31, 2013, 2014, and 2015

were $122 million, $167 million, and $53 million, respectively.

As of December 31, 2015, there was $17 million of unamortized stock-based compensation expense

related to unvested stock options, which is expected to be recognized over a weighted average

period of 1.7 years.

Cash received from option exercises and purchases of shares under the Employee Stock Purchase

Plan for the year ended December 31, 2015 was $59 million.

The total net tax benefit attributable to stock options exercised in the year ended December 31, 2015

was $15 million.

141