Yahoo 2015 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2015 Yahoo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.An accounting policy is considered to be critical if it requires an accounting estimate to be made

based on assumptions about matters that are highly uncertain at the time the estimate is made, and if

different estimates that reasonably could have been used, or changes in the accounting estimate that

are reasonably likely to occur, could materially impact the consolidated financial statements. We

believe that the following critical accounting policies reflect the more significant estimates and

assumptions used in the preparation of our consolidated financial statements.

Management has discussed the development and selection of these critical accounting estimates

with the Audit and Finance Committee (the “Audit Committee”) of our Board, and the Audit

Committee has reviewed the disclosure below. In addition, there are other items within our financial

statements that require estimation, but are not deemed critical as defined above. Changes in

estimates used in these and other items could have a material impact on our consolidated financial

statements.

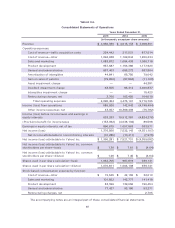

Revenue Recognition. Our revenue is generated from search and display advertising, and other

sources. Display advertising revenue is generated from the display of graphical, non-graphical, and

video advertisements and search advertising revenue is generated from clicks on text-based links to

advertisers’ websites that appear primarily on search results pages, and from revenue sharing

arrangements with partners for search technology and services. Other revenue consists of listings-

based services revenue, transaction revenue, and fees revenue. While the majority of our revenue

transactions contain standard business terms and conditions, there are certain transactions that

contain contract-specific business terms and conditions. In addition, we enter into certain sales

transactions that involve multiple elements (arrangements with more than one deliverable). We also

enter into arrangements to purchase goods and/or services from certain customers. As a result,

significant contract interpretation is sometimes required to determine the appropriate accounting for

these transactions including: (1) whether an arrangement exists; (2) whether fees are fixed or

determinable; (3) how the arrangement consideration should be allocated among potential multiple

elements; (4) establishing selling prices for deliverables considering multiple factors; (5) when to

recognize revenue on the deliverables; (6) whether all elements of the arrangement have been

delivered; (7) whether the arrangement should be reported gross as a principal versus net as an

agent; (8) whether we receive a separately identifiable benefit from the purchase arrangements with

certain customers for which we can reasonably estimate fair value; and (9) whether the consideration

received from a vendor should be characterized as revenue or a reimbursement of costs incurred. In

addition, our revenue recognition policy requires an assessment as to whether collection is

reasonably assured, which inherently requires us to evaluate the creditworthiness of our customers.

Changes in judgments on these assumptions could materially impact the timing or amount of revenue

recognition.

Income Taxes. Significant judgment is required in evaluating our uncertain tax positions and

determining our provision for income taxes. See Note 16—“Income Taxes” in the Notes to our

consolidated financial statements for additional information. We establish liabilities for tax-related

uncertainties based on estimates of whether, and the extent to which, additional taxes will be due.

These liabilities are established when we believe that certain positions might be challenged despite

our belief that our tax return positions are in accordance with applicable tax laws. We adjust these

liabilities in light of changing facts and circumstances, such as the closing of a tax audit, new tax

legislation, developments in case law or interactions with the tax authorities. To the extent that the

final tax outcome of these matters is different than the amounts recorded, such differences will affect

the provision for income taxes in the period in which such determination is made. The provision for

income taxes includes the effect of liability provisions and changes to reserves that are considered

appropriate, as well as the related net interest and penalties.

We record a valuation allowance against certain of our deferred income tax assets if it is more likely

than not that those assets will not be realized. In evaluating our ability to realize our deferred income

77