Yahoo 2015 Annual Report Download - page 163

Download and view the complete annual report

Please find page 163 of the 2015 Yahoo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

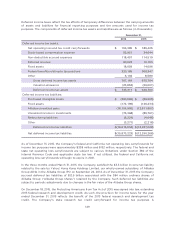

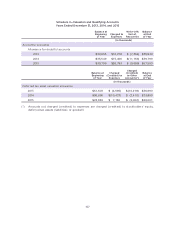

(3) Net income attributable to Yahoo! Inc. for the quarter ended September 30, 2014 includes a

gain from sale of Alibaba Group shares of $6.3 billion, net of tax and net restructuring charges

of $8 million.

(4) Net income attributable to Yahoo! Inc. for the quarter ended December 31, 2014 includes a gain

on sale of patents of $35 million, a gain on Hortonworks warrants of $98 million, a goodwill

impairment charge of $88 million, and net restructuring charges of $33 million.

(5) Net income attributable to Yahoo! Inc. for the quarter ended March 31, 2015 includes a gain on

sale of patents of $2 million, a loss of $12 million due to the decline in fair value of the

Hortonworks warrants, and net restructuring charges of $51 million.

(6) Net loss attributable to Yahoo! Inc. for the quarter ended June 30, 2015 includes a gain on sale

of patents of $9 million, a gain of $5 million due to the increase in fair value of the Hortonworks

warrants, and net restructuring charges of $20 million.

(7) Net income attributable to Yahoo! Inc. for the quarter ended September 30, 2015 includes, a

loss of $13 million due to the decline in fair value of the Hortonworks warrants, asset impairment

charge of $42 million related to the acquired and originally developed content, and net

restructuring charges of $26 million.

(8) Net loss attributable to Yahoo! Inc. for the quarter ended December 31, 2015 includes goodwill

impairment charge of $4.5 billion, asset impairment charge of $2 million related to the originally

developed content, intangible impairment charge of $15 million, and net restructuring charges

of $7 million.

Item 9. Changes in and Disagreements With

Accountants on Accounting and Financial

Disclosure

None.

Item 9A. Controls and Procedures

Evaluation of Disclosure Controls and Procedures

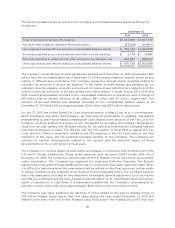

The Company’s management, with the participation of the Company’s principal executive officer and

principal financial officer, has evaluated the effectiveness of the Company’s disclosure controls and

procedures (as such term is defined in Rules 13a-15(e) and 15d-15(e) under the Exchange Act) as of

the end of the period covered by this report. Based on such evaluation, the Company’s principal

executive officer and principal financial officer have concluded that, as of the end of such period, the

Company’s disclosure controls and procedures were effective.

Management’s Report on Internal Control Over Financial

Reporting

The Company’s management is responsible for establishing and maintaining adequate internal

control over financial reporting as defined in Rules 13a-15(f) and 15d-15(f) under the Exchange Act.

Under the supervision and with the participation of the Company’s management, including its

principal executive officer and principal financial officer, the Company conducted an evaluation of the

effectiveness of its internal control over financial reporting based on criteria established in the

159