Humana 2013 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2013 Humana annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Humana Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

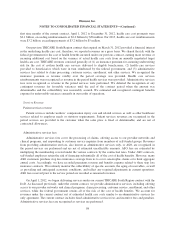

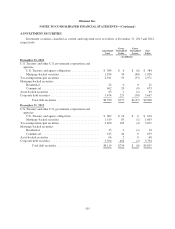

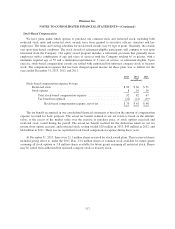

5. FAIR VALUE

Financial Assets

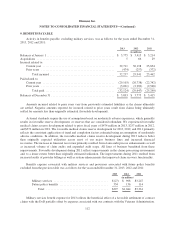

The following table summarizes our fair value measurements at December 31, 2013 and 2012, respectively,

for financial assets measured at fair value on a recurring basis:

Fair Value Measurements Using

Fair Value

Quoted Prices

in Active

Markets

(Level 1)

Other

Observable

Inputs

(Level 2)

Unobservable

Inputs

(Level 3)

(in millions)

December 31, 2013

Cash equivalents ................................. $ 876 $ 876 $ 0 $ 0

Debt securities:

U.S. Treasury and other U.S. government

corporations and agencies:

U.S. Treasury and agency obligations ........ 584 0 584 0

Mortgage-backed securities ................ 1,820 0 1,820 0

Tax-exempt municipal securities ................ 2,971 0 2,958 13

Mortgage-backed securities:

Residential ............................. 22 0 22 0

Commercial ............................. 673 0 673 0

Asset-backed securities ........................ 63 0 62 1

Corporate debt securities ...................... 3,667 0 3,644 23

Total debt securities .................. 9,800 0 9,763 37

Total invested assets .......................... $10,676 $ 876 $9,763 $37

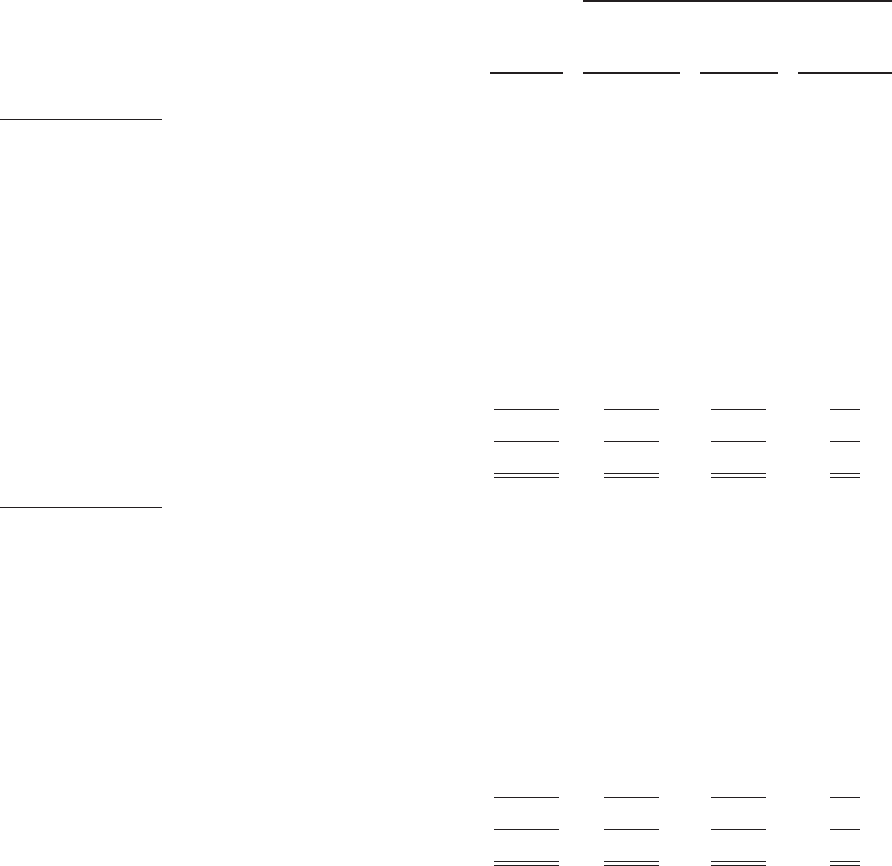

December 31, 2012

Cash equivalents ................................. $ 1,177 $1,177 $ 0 $ 0

Debt securities:

U.S. Treasury and other U.S. government

corporations and agencies:

U.S. Treasury and agency obligations ........ 618 0 618 0

Mortgage-backed securities ................ 1,603 0 1,603 0

Tax-exempt municipal securities ................ 3,071 0 3,058 13

Mortgage-backed securities:

Residential ............................. 34 0 34 0

Commercial ............................. 659 0 659 0

Asset-backed securities ........................ 68 0 67 1

Corporate debt securities ...................... 3,794 0 3,770 24

Total debt securities .................. 9,847 0 9,809 38

Total invested assets .......................... $11,024 $1,177 $9,809 $38

There were no material transfers between Level 1 and Level 2 during 2013 or 2012.

108