Electronic Arts 2014 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2014 Electronic Arts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report

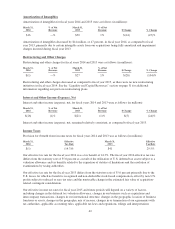

In addition to considering forecasts of future taxable income, we are also required to evaluate and quantify other

possible sources of taxable income in order to assess the realization of our deferred tax assets, namely the

reversal of existing deferred tax liabilities, the carry back of losses and credits as allowed under current tax law,

and the implementation of tax planning strategies. Evaluating and quantifying these amounts involves significant

judgments. Each source of income must be evaluated based on all positive and negative evidence; this evaluation

involves assumptions about future activity. Certain taxable temporary differences that are not expected to reverse

during the carry forward periods permitted by tax law cannot be considered as a source of future taxable income

that may be available to realize the benefit of deferred tax assets.

Based on the assumptions and requirements noted above, we have recorded a valuation allowance against most of

our U.S. deferred tax assets. In addition, we expect to provide a valuation allowance on future U.S. tax benefits

until we can sustain a level of profitability in the U.S., or until other significant positive evidence arises that

suggest that these benefits are more likely than not to be realized.

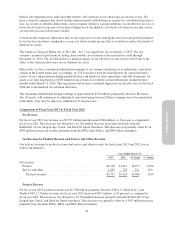

In the ordinary course of our business, there are many transactions and calculations where the tax law and

ultimate tax determination is uncertain. As part of the process of preparing our Consolidated Financial

Statements, we are required to estimate our income taxes in each of the jurisdictions in which we operate prior to

the completion and filing of tax returns for such periods. This process requires estimating both our geographic

mix of income and our uncertain tax positions in each jurisdiction where we operate. These estimates involve

complex issues and require us to make judgments about the likely application of the tax law to our situation, as

well as with respect to other matters, such as anticipating the positions that we will take on tax returns prior to

our actually preparing the returns and the outcomes of disputes with tax authorities. The ultimate resolution of

these issues may take extended periods of time due to examinations by tax authorities and statutes of limitations.

In addition, changes in our business, including acquisitions, changes in our international corporate structure,

changes in the geographic location of business functions or assets, changes in the geographic mix and amount of

income, as well as changes in our agreements with tax authorities, valuation allowances, applicable accounting

rules, applicable tax laws and regulations, rulings and interpretations thereof, developments in tax audit and other

matters, and variations in the estimated and actual level of annual pre-tax income can affect the overall effective

income tax rate.

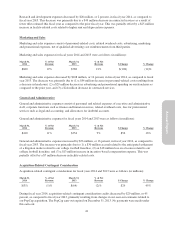

RESULTS OF OPERATIONS

Our fiscal year is reported on a 52- or 53-week period that ends on the Saturday nearest March 31. Our results of

operations for the fiscal years ended March 31, 2014, 2013 and 2012 each contained 52 weeks and ended on

March 29, 2014, March 30, 2013, and March 31, 2012, respectively. For simplicity of disclosure, all fiscal

periods are referred to as ending on a calendar month-end.

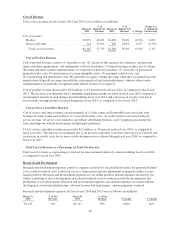

Net Revenue

Net revenue consists of sales generated from (1) video games sold as packaged goods or as digital downloads and

designed for play on video game consoles (such as the PlayStation 3 and 4 from Sony and Xbox 360 and One

from Microsoft) and PCs, (2) video games for mobile phones and tablets , (3) separate software products and

content and online game services associated with these products, (4) licensing our game software to third parties,

(5) allowing other companies to manufacture and sell our products in conjunction with other products, and

(6) advertisements on our online web pages and in our games.

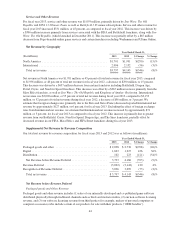

We provide three different measures of our Net Revenue. Two of these measures are presented in accordance

with U.S. GAAP – (1) Net Revenue by Product revenue and Service and other revenue and (2) Net Revenue by

Geography. The third measure is a non-GAAP financial measure – Net Revenue before Revenue Deferral by

Revenue Composition, which is primarily based on method of distribution. We use this third non-GAAP

financial measure internally to evaluate our operating performance, when planning, forecasting and analyzing

future periods, and when assessing the performance of our management team.

Management places a greater emphasis and focus on assessing our business through a review of the Net Revenue

before Revenue Deferral by Revenue Composition than by Net Revenue by Product revenue and Service and

other revenue. These two measures differ as (1) Net Revenue by Product revenue and Service and other revenue

35