BB&T 2007 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2007 BB&T annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BB&T CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

Incentive Plan (“Omnibus Plan”), the Non-Employee Directors’ Stock Option Plan (“Directors’ Plan”), and plans

assumed from acquired entities, which are described below. All plans generally allow for accelerated vesting of

awards for holders who retire and have met all retirement eligibility requirements and in connection with certain

other events. BB&T’s shareholders have approved all equity-based compensation plans with the exception of

plans assumed from acquired companies. BB&T changed its practices regarding equity-based awards in 2006 and

began issuing a combination of restricted share units and nonqualified stock options in connection with its

incentive plans. Formerly, the Company had issued substantially all of its equity-based awards in the form of

stock options. As of December 31, 2007, the 2004 Plan is the only plan that has shares available for future grants.

BB&T’s 2004 Plan is intended to assist the Corporation in recruiting and retaining employees, directors and

independent contractors and to associate the interests of eligible participants with those of BB&T and its

shareholders. At December 31, 2007, there were 11.2 million non-qualified and qualified stock options at prices

ranging from $8.11 to $50.71 and 4.0 million restricted shares and restricted share units outstanding under the

2004 Plan. The options outstanding under the 2004 Plan generally vest ratably over five years and have a

ten-year term. The restricted shares and restricted share units generally vest five years from the date of grant.

At December 31, 2007, there were 18.8 million shares available for future grants under the 2004 Plan.

BB&T’s Omnibus Plan was intended to allow BB&T to recruit and retain employees with ability and

initiative and to align the employees’ interests with those of BB&T and its shareholders. At December 31, 2007,

6.0 million qualified stock options at prices ranging from $11.66 to $48.01 and 20.1 million non-qualified stock

options at prices ranging from $11.36 to $53.10 were outstanding. The stock options generally vest over 3 to 5

years and have a 10-year term.

The Directors’ Plan was intended to provide incentives to non-employee directors to remain on the Board of

Directors and share in the profitability of BB&T. In 2005, the Directors’ Plan was amended and no future grants

will be awarded in connection with this Plan. At December 31, 2007, options to purchase 430 thousand shares of

common stock at prices ranging from $20.74 to $31.80 were outstanding pursuant to the Directors’ Plan.

BB&T also has equity-based plans outstanding as the result of assuming the plans of acquired companies. At

December 31, 2007, there were 245 thousand stock options outstanding in connection with these plans, with option

prices ranging from $22.62 to $29.54.

BB&T measures the fair value of each option award on the date of grant using the Black-Scholes option-

pricing model with the following weighted average assumptions used for grants awarded in 2007, 2006 and 2005,

respectively:

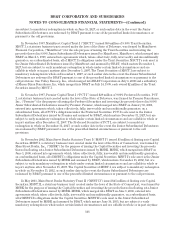

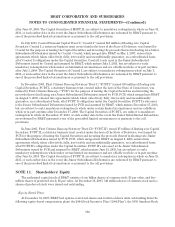

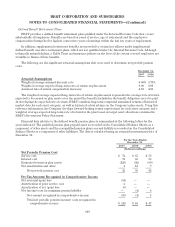

For the Years Ended December 31,

2007 2006 2005

Assumptions:

Risk-free interest rate 4.7% 4.6% 4.1%

Dividend yield 4.0 3.8 3.5

Volatility factor 14.0 16.0 20.0

Expected life 6.9yrs 6.5yrs 6.5yrs

Fair value of options per share $5.34 $5.58 $6.52

BB&T determines the assumptions used in the Black-Scholes option pricing model as follows: the risk-free

interest rate is based on the U.S. Treasury yield curve in effect at the time of the grant; the dividend yield is

based on the historical dividend yield of BB&T’s stock, adjusted to reflect the expected dividend yield over the

expected life of the option; the volatility factor is based on the historical volatility of BB&T’s stock, adjusted to

reflect the ways in which current information indicates that the future is reasonably expected to differ from the

past; and the weighted-average expected life is based on the historical behavior of employees related to exercises,

forfeitures and cancellations.

103