BB&T 2007 Annual Report Download - page 14

Download and view the complete annual report

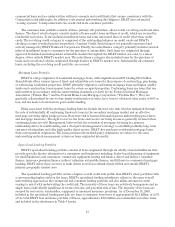

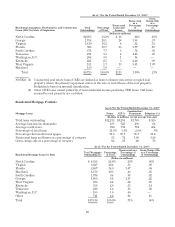

Please find page 14 of the 2007 BB&T annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.base that is substantially located within the Corporation’s primary market area. At the same time, the loan

portfolio is geographically dispersed throughout BB&T’s branch network to mitigate concentration risk arising

from local and regional economic downturns.

The following discussion presents the principal types of lending conducted by BB&T and describes the

underwriting procedures and overall risk management of BB&T’s lending function. The relative risk of each loan

portfolio is presented in the “Asset Quality” section of “Management’s Discussion and Analysis of Financial

Condition and Results of Operations” herein.

Underwriting Approach

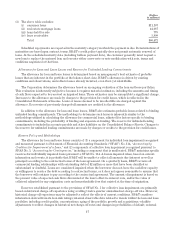

Recognizing that the loan portfolio is a primary source of profitability, proper loan underwriting is critical to

BB&T’s long-term financial success. BB&T’s underwriting approach is designed to define acceptable

combinations of specific risk-mitigating features that ensure credit relationships conform to BB&T’s risk

philosophy. Provided below is a summary of the most significant underwriting criteria used to evaluate new loans

and loan renewals:

ŠCash flow and debt service coverage—cash flow adequacy is a necessary condition of creditworthiness,

meaning that loans not clearly supported by a borrower’s cash flow must be justified by secondary

repayment sources.

ŠSecondary sources of repayment—alternative repayment funds are a significant risk-mitigating factor as

long as they are liquid, can be easily accessed and provide adequate resources to supplement the primary

cash flow source.

ŠValue of any underlying collateral—loans are generally secured by the asset being financed. Because an

analysis of the primary and secondary sources of repayment is the most important factor, collateral,

unless it is liquid, does not justify loans that cannot be serviced by the borrower’s normal cash flows.

ŠOverall creditworthiness of the customer, taking into account the customer’s relationships, both past and

current, with other lenders—our success depends on building lasting and mutually beneficial relationships

with clients, which involves assessing their financial position and background.

ŠLevel of equity invested in the transaction—in general, borrowers are required to contribute or invest a

portion of their own funds prior to any loan advances.

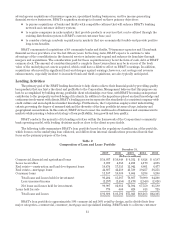

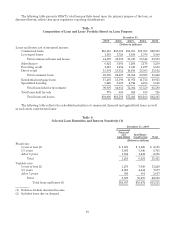

Commercial Loan and Lease Portfolio

The commercial loan and lease portfolio represents the largest category of the Corporation’s total loan

portfolio. BB&T’s commercial lending program is generally targeted to serve small-to-middle market businesses

with sales of $200 million or less. In addition, BB&T’s Corporate Banking Group provides lending solutions to

large corporate clients. Traditionally, lending to small and mid-sized businesses has been among BB&T’s

strongest market segments.

Commercial and small business loans are primarily originated through BB&T’s banking network. In

accordance with the Corporation’s lending policy, each loan undergoes a detailed underwriting process, which

incorporates BB&T’s underwriting approach, procedures and evaluations described above. In addition, Branch

Bank has adopted an internal maximum credit exposure lending limit of $245 million for a “best grade” credit,

which is considerably below Branch Bank’s maximum legal lending limit. Commercial loans are typically priced

with an interest rate tied to market indices, such as the prime rate and the London Interbank Offered Rate

(“LIBOR”), or a fixed-rate. Commercial loans are individually monitored and reviewed for any possible

deterioration in the ability of the client to repay the loan. Approximately 93% of BB&T’s commercial loans are

secured by real estate, business equipment, inventories and other types of collateral. BB&T’s commercial leases

consist of investments in various types of leveraged lease transactions.

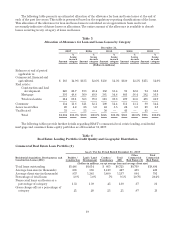

Consumer Loan Portfolio

BB&T offers a wide variety of consumer loan products. Various types of secured and unsecured loans are

marketed to qualifying existing clients and to other creditworthy candidates in BB&T’s market area. These loans

are relatively homogenous and no single loan is individually significant in terms of its size and potential risk of

loss. Consumer loans are subject to the same rigorous lending policies and procedures as described above for

14